The September 2 week starts with the Labor Day observance on Monday with a full market close in the US for stocks and bonds. The data calendar will have a few shifts in the normal release schedule with the weekly MBA numbers on mortgage applications on Thursday instead of Wednesday, and the monthly ADP report also on Thursday instead of Wednesday.

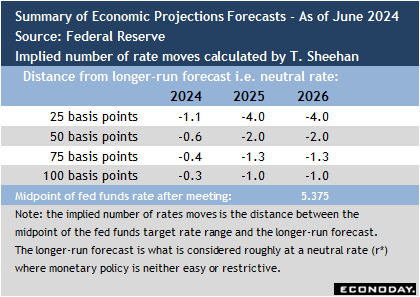

Now that Fed Chair Jerome Powell has given an unmistakable message for a rate cut at the September 17-18 FOMC meeting, speculation will be about the size and timing of future rate cuts. Could the FOMC impose a 50-basis point cut in September rather than the 25-basis points that is widely expected? Will the FOMC forecast one or two more cuts in 2024? Will it pick up the pace for future rate hikes in 2025 and 2026? Could it lower the projected path of the fed funds target rate?

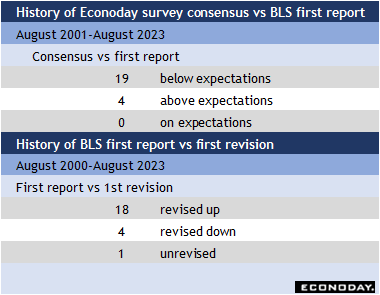

Some of these questions hinge on the contents of the monthly employment report for August when it is released at 8:30 ET on Friday. The July report presented a downside surprise with a payroll increase of 114,000 and a downward net revision of 29,000 to the prior two months, combined with a 2 tenths increase in the unemployment rate to 4.3 percent. The results sparked worries that the labor market was cooling more quickly than previously thought. A second below-expectations report could be more worrisome. However, it should also be noted that nonfarm payrolls frequently come in below the market consensus and are subsequently revised higher.

Early forecasts for nonfarm payrolls look for an increase of somewhere between 150,000-175,000 in August. The unemployment rate is expected to retreat by a tenth to 4.2 percent. If realized, this should offer some reassurance that though the labor market has cooled, it is not worrisomely weaker.

Powell recently said, “We do not seek or welcome further cooling in labor market conditions.” Against this backdrop a weak August employment report could affect the FOMC’s collective forecast when it updates the summary of economic projections (SEP) at the upcoming meeting. But Fed policymakers are going to delve deep into the totality of the data about the labor market, not just one report.

The week will also include important data Challenger numbers on announced layoff intentions for July at 7:30 ET on Thursday and ADP’s national employment report for August at 8:15 ET on Thursday. Other readings on job openings and labor turnover (JOLTS) will be a little behind with numbers for July, but should help shape the labor market picture when the data are reported at 10:00 ET on Wednesday.

Past performance is not indicative of future results

—

Originally Posted August 30, 2024 – High points for US economic data for September 2 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account