The communications blackout period around the September 17-18 FOMC meeting is in effect (midnight, Saturday, September 7 through midnight, Thursday, September 19). If any Fed officials speak, it will not be about monetary policy. Even if it were not the blackout period, FOMC participants would probably say nothing to contradict expectations for a 25-basis point rate cut at the meeting, the first since July 2023 when the fed funds target rate reached its near-term peak of 5.25-5.50 percent.

The only piece of economic data likely to get more than passing attention in the week is the August CPI report on Wednesday at 8:30 ET. On the price stability side of the Fed’s dual mandate, getting inflation under control has been a challenge. Inflation measures are generally moving in the right direction but it has taken time to rein in price inflation for housing and non-housing services. Recent data suggest that the FOMC is nearly there, although further gains are generally incremental. It will take some months more before the 2 percent inflation objective is reached.

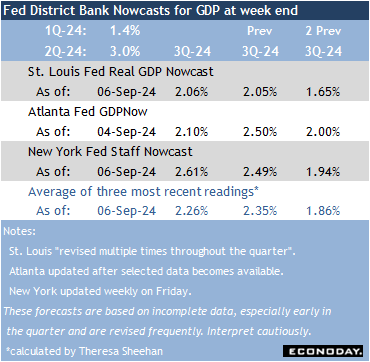

In the meantime, labor market data are now looking the most normal since the arrival of the pandemic against a backdrop of tempered economic expansion. Having seen the labor market rebalance and cool to sustainable levels, the FOMC will be willing to remove a little of the restrictive monetary policy currently in place.

Past performance is not indicative of future results

—

Originally Posted Sepetmber 6, 2024 – High points for US data scheduled for Sept. 9 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account