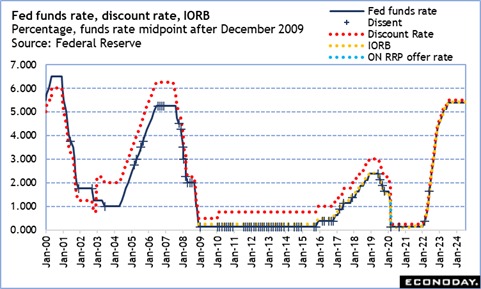

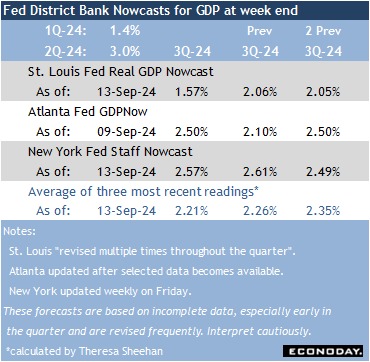

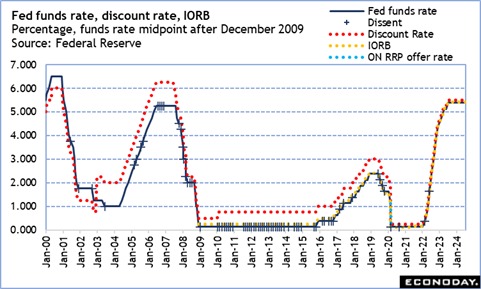

The FOMC meets on Tuesday and Wednesday amid universal expectations for the first rate cut since the current target range of 5.25-5.50 percent was set in July last year. What is not universal is the expected size of the cut. There are calls from Fed watchers for a 50-basis-point reduction due to perceived deceleration in the US economy. However, GDP Nowcasts from Fed district banks are tracking above 2 percent for the third quarter that would follow the second quarter’s 3.0 percent rise. A 25-basis point cut is a much more realistic expectation.

Although labor market data in July and August were comparatively soft, this performance is only disappointing compared to the hot jobs market in 2022 and 2023. Underlying labor market conditions are consistent with a normal economy in modest expansion. Fed policymakers will take this into account along with the incremental improvements in core inflation measures and overall stability in medium-term inflation expectations.

Additionally, the recent easing in financial markets has done some of the work of easing restrictive monetary policy, reducing the need for a larger rate cut on the part of the FOMC. If September’s summary of economic projections (SEP) looks for more and/or sooner reductions in the fed funds rate, financial market conditions will probably ease further in anticipation.

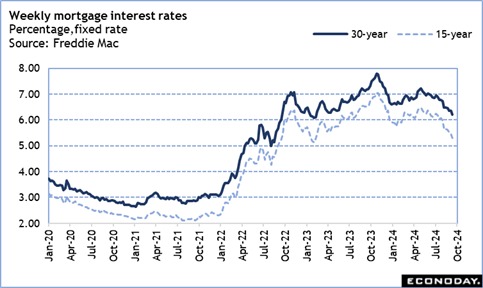

Such will likely be visible in some of the week’s housing market data. The Freddie Mac 30-year rate for a fixed rate mortgage is down to 6.20 percent in the September 12 week, its lowest since 6.12 percent in the February 9, 2023 week. This is low enough to spark activity in the housing market where potential homebuyers have been holding off in hopes of a more favorable mortgage rate to improve affordability. This is also low enough to get holders of higher rate mortgages – both fixed and adjustable rate – to refinance. Moreover, holders of lower rate mortgages may find it stings less to up- or downgrade to a new home in the current environment, or that it’s a reasonable time to refinance and take out some equity for purposes like home renovation or starting a business.

The decline in rates may not be visible in the housing market reports through August such as existing home sales at 10:00 ET on Thursday or housing starts and building permits at 8:30 ET on Wednesday. However, the NAHB housing market index for September at 10:00 ET on Tuesday should bounce back from the reading of 39 in August which was the lowest since 37 in December 2023. New construction may not see quite as much demand as it did when the supply of existing homes available for sale was exceptionally lean in a fiercely competitive market, but construction should recover now that prices are not escalating as quickly and mortgage rates have improved affordability. Some renters may be considering purchasing.

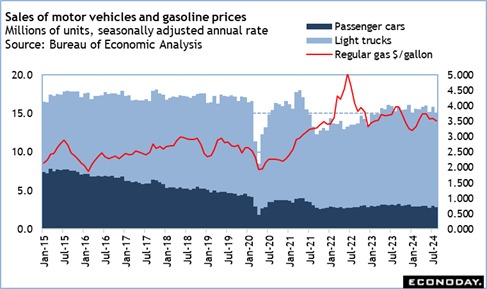

One more thing to keep an eye on in the week are the August numbers for retail sales at 8:30 ET on Tuesday and whether consumer spending is going to hold up in the third quarter 2024. August’s dip in the pace of vehicle sales will hold down the headline level as will sales at gasoline stations due to lower prices. However, August could get a boost from back-to-school sales tax holidays as well as the early stocking of holiday merchandise now in stores for Halloween, Thanksgiving, and Christmas.

Past performance is not indicative of future results

—

Originally Posted September 13, 2024 – High points for US data in September 16 week

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account