Tomorrow is the big one – the August employment report. Last week, Nvidia (NVDA) was understandably the biggie, even if its good but not great results, failed to cause broader repercussions. But it is nearly impossible to assert that non-consensus August Nonfarm Payrolls and/or Unemployment would fail to move stock and bond markets. The upcoming FOMC meeting potentially hinges upon those numbers. A Goldilocks scenario around consensus – not too hot, not too cold – is what equity bulls require.

Hyperbole? Perhaps. However, the recent Jackson Hole address by Federal Reserve Chair Powell (aka “Goldilocks in a Suit”) seemed to all but promise a rate cut at the September 18th meeting, and more importantly, reaffirmed that after years of seeming to solely focus upon the “stable prices” portion of the Federal Reserve’s dual mandate, the “maximum employment” goal is now in play after a few months of weaker labor data. Thus, with a minimum of 25 basis points a near-certainty, the labor report is viewed as the most important factor toward a potential 50 bp cut.

Considering the markets’ mood, the reports need to thread a fairly narrow window around consensus, which is currently around 165,000 for Nonfarm Payrolls and a 4.2% Unemployment Rate. It currently shows a 65% likelihood that August payrolls will exceed 147,500 which broadly fits with the current consensus. (Remember, consensus expectations can move after a contract is listed).

The key for most investors and traders is not to figure out what the number will be, but instead, how the markets might react to various scenarios. Considering that fixed income traders seem roughly split between expecting 25 and 50 bp at the next meeting, and that a substantially weaker number would pump up the chances of 50bp, while a significantly stronger one would dash hopes for a larger cut, a number that widely deviates from consensus would mean that a large percentage of investors would be caught offsides. And when traders are caught offsides, volatility ensues. (Note: as of midday, the CME FedWatch tool shows a 39% likelihood for a 50bp cut in September, while ForecastTrader shows 81% likelihood for a Fed Funds rate set above 4.875%),

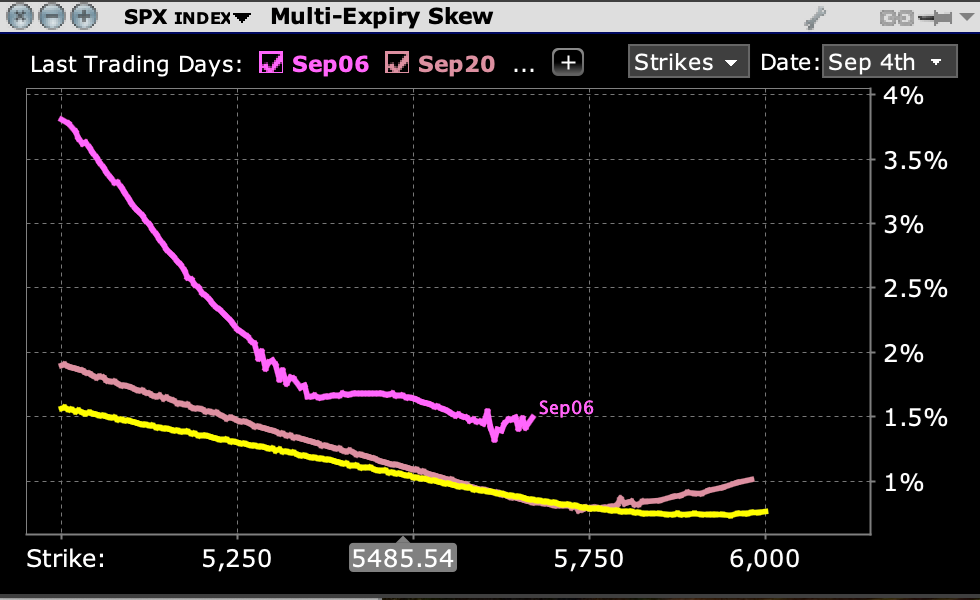

After a failed rally attempt this morning, fueled by another bout of “buy-the-dip” in megacap tech stocks, we see risk-averse sentiment return to equity markets. The Cboe Volatility Index (VIX) briefly dipped below 20 this morning but has now returned to a 21 handle. At-money options the for S&P 500 Index (SPX) that expire tomorrow are pricing in a roughly 1.65% move, though we see a very steep downside skew below 5,350:

Skews for SPX Options Expiring September 6th (magenta), September 20th (pink), October 17th (yellow)

Source: Interactive Brokers

Past performance is not indicative of future results

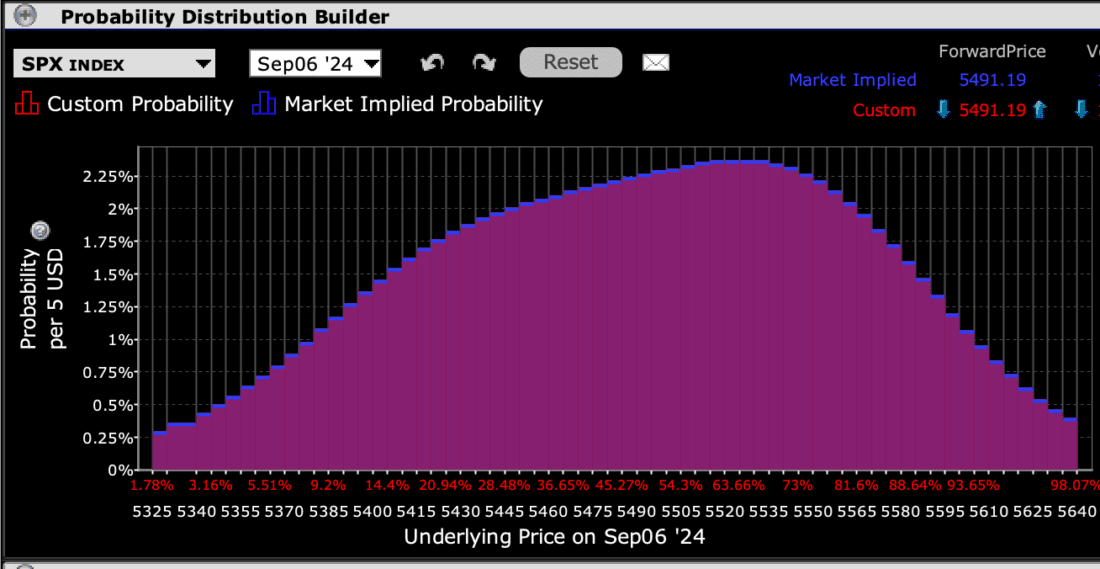

Meanwhile, as we might intuit from the large flattish area in the top curve above, the IBKR Probability Lab shows a wide dispersion among the most likely outcomes, even if the peak probability remains about 1% above the current index level:

IBKR Probability Lab for SPX Options Expiring September 6th, 2024

Source: Interactive Brokers

Past performance is not indicative of future results

Here’s the bottom line. Since rate cuts have become a near-certainty we’ve entered a “bad news is bad” environment. The danger in really bad news is that even if the Fed is prepared to react aggressively, it might be too late to stave off real economic weakness. But there is a worry that if the news is too good, that the Fed might be reticent to cut rates as fast as the market has come to expect. A data-dependent Fed is not likely to offer the four 25bp cuts that the markets expect to arrive during the remaining three FOMC meetings this year. Thus, a “Goldilocks” payrolls report – not too hot, not too cold – is what equity bulls should desire.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account