I’ve begun to wonder how many of you hit “buy ES” or “buy NQ” before brushing your teeth. We had the usual pattern this morning: futures with a modest move (higher today) when many US-based traders were waking up followed by a lift into the official open. After a three-day selloff, which was very out of character for the recent market environment, we saw a Tesla-led rally yesterday and a resumption of the “animal spirits” for the past two mornings. Today those market-based “animal spirits” were boosted by data from the University of Michigan, when it reported that Consumer Sentiment rose to a four-month high, and 1-Year inflationary expectations dipped to 2.7%.

As I type this around midday, some of the enthusiasm has ebbed. The S&P 500 (SPX) was up nearly 1% at its high, but it has given back about half its gains. Tech stocks are performing better, with all the Mag 7 stocks and most semiconductor stocks trading higher. There were headlines that the Nasdaq Composite Index (COMP) hit an all-time high. That said, the much more widely traded Nasdaq 100 (NDX) hasn’t yet topped its July 10 high, though it is just about 1% shy. Part of that is the ongoing push-pull between stocks and bonds. Treasury yields were a few basis points lower before the 10am EDT release but have now slipped back to roughly unchanged levels.

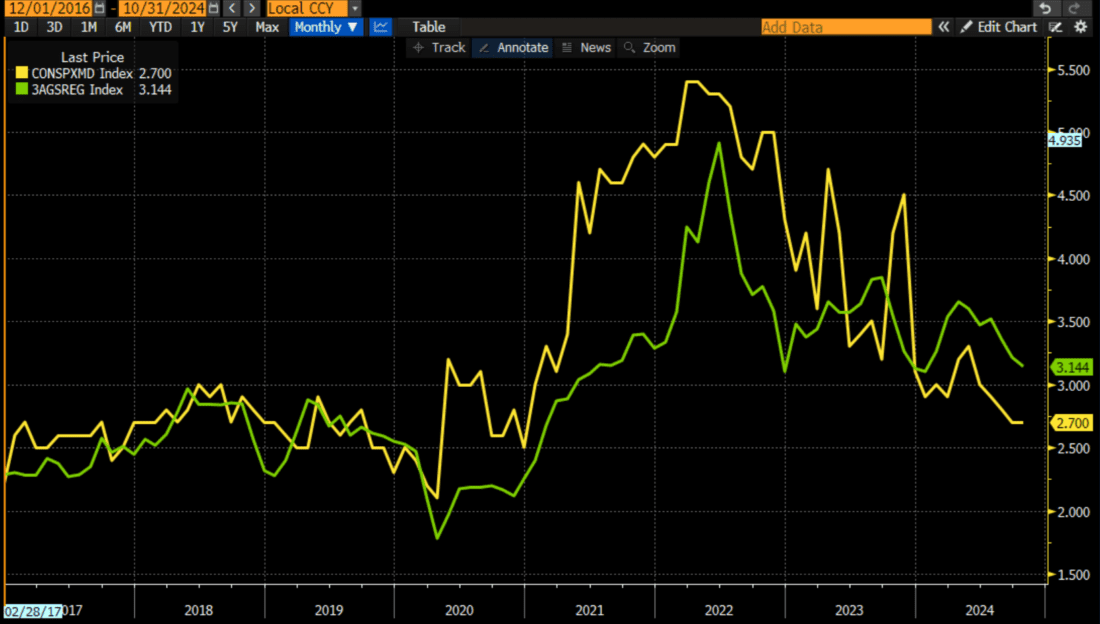

While it is certainly good news that inflationary expectations are cooling, we’ve noted before that the Michigan 1-Year Expectations seem highly dependent upon prices at the pump. For almost all of this year they have moved in virtual lockstep:

University of Michigan 1-Year Inflation Expectations (yellow) vs. AAA National Average Gasoline Prices (green), since December 2016

Source: Bloomberg

Past performance is not indicative of future results

It would be pointless to be dismissive of a welcome economic development, but considering that it appears to be dependent upon an input that economists routinely leave out of their inflation analysis – they’re always focused on “Core” data, which excludes volatile food and energy prices, it’s understandable why the early enthusiasm for the Michigan readings faded. If bonds don’t like them, then stocks won’t like them as much either.

But there is no disputing the sentiment in the market’s most important sector – big tech. TSLA is a bit of an outlier when we examine its business relative to many of its other major peers – its main business involves manufacturing something other than semiconductors, even as they are trying to be a major AI leader – but its role in the market’s mindshare remains important. The TSLA earnings response seemed to rekindle enthusiasm for all things big tech. Thus, the rotation trade can wait a day. It’s once again about big tech, at least for now.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Mutual Funds

Not all funds are available to retail investors. Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds' assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please visit the Mutual Funds section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account