1/ Not Enough Conviction in Tesla

2/ Game Over for Super Micro Computer?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

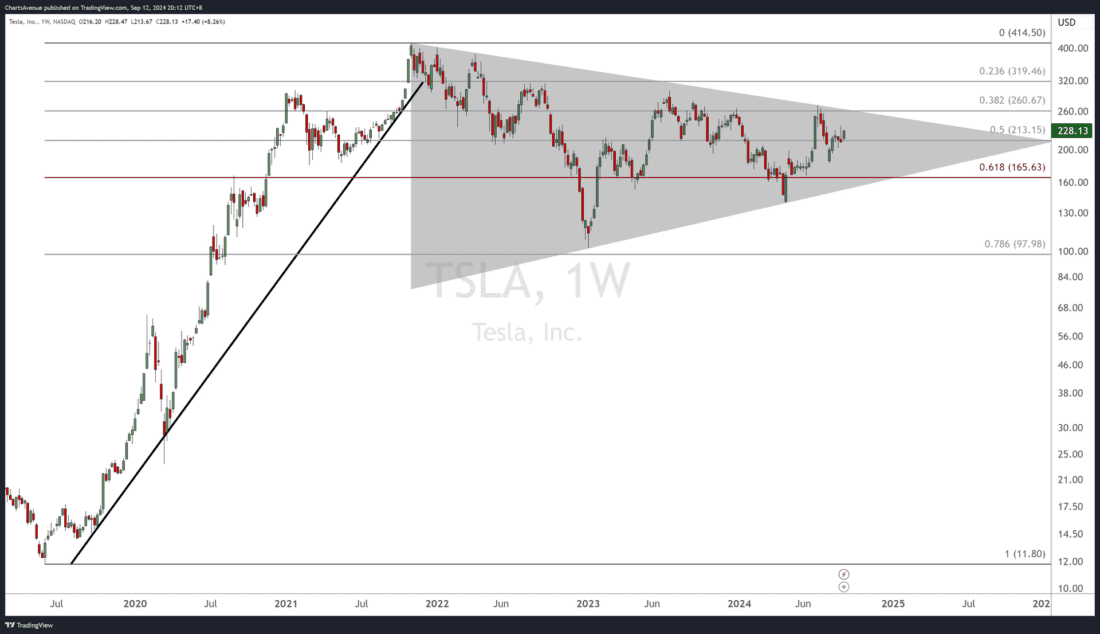

Not Enough Conviction in Tesla

Tesla is trading within a symmetrical triangle which remains in force until the price is able to break out (or breakdown) of it. In other words, a move through support or resistance should determine the next direction of the stock price, currently there is not enough conviction in either direction to determine the outcome.

Past performance is not indicative of future results

Once the price is able to move out of this symmetrical triangle, the Fibonacci retracement levels will come into play. These retracements are arrived at by first measuring a complete trend up or down, in this case the June 2019 to November 2021 advance. These calculated levels then act as support on the way down for price, and once surpassed, they then act as resistance levels. The levels outside the symmetrical triangle are $260 on the way up and $165 on the way down.

2/

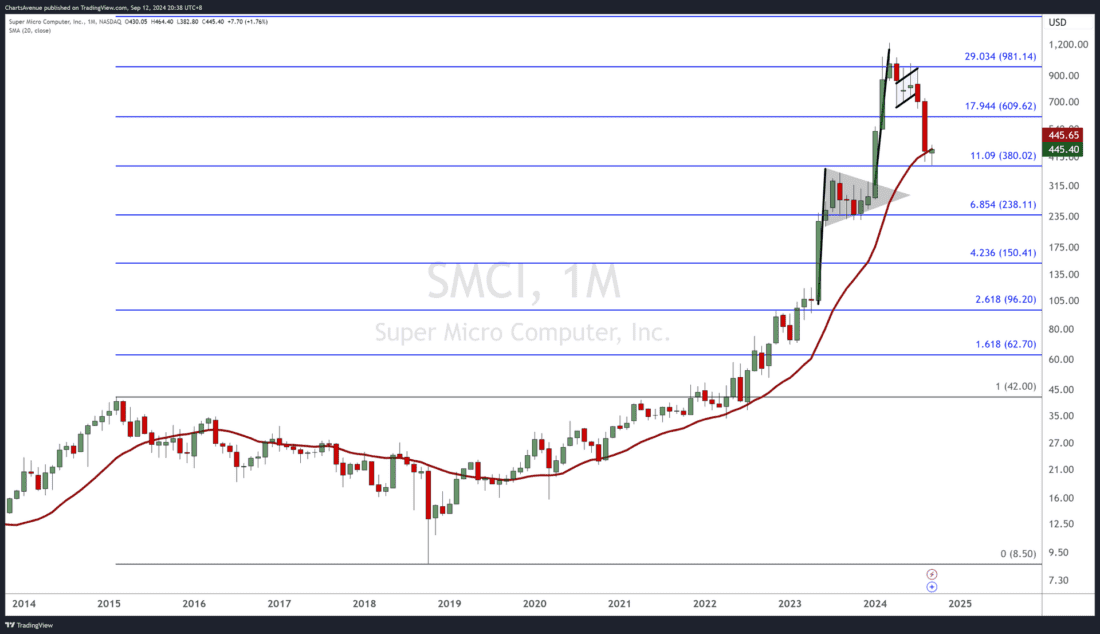

Game Over for Super Micro Computer?

From an all-time high at $1229, SMCI stock price fell (collapsed?) to a low of $382.80, in just 6 months. Can this decline still be considered as a pullback within an uptrend? This could actually be qualified as a reversion to the mean, as the price has now reversed back to the 20-month moving average, which has been acting as a dynamic support since 2020.

Past performance is not indicative of future results

As long as the price trades above the $380 support zone, which represents the current month low as well as a Fibonacci extension taken off the February 2015 to October 2018 decline, it is not game over yet for Super Micro Computer.

3/

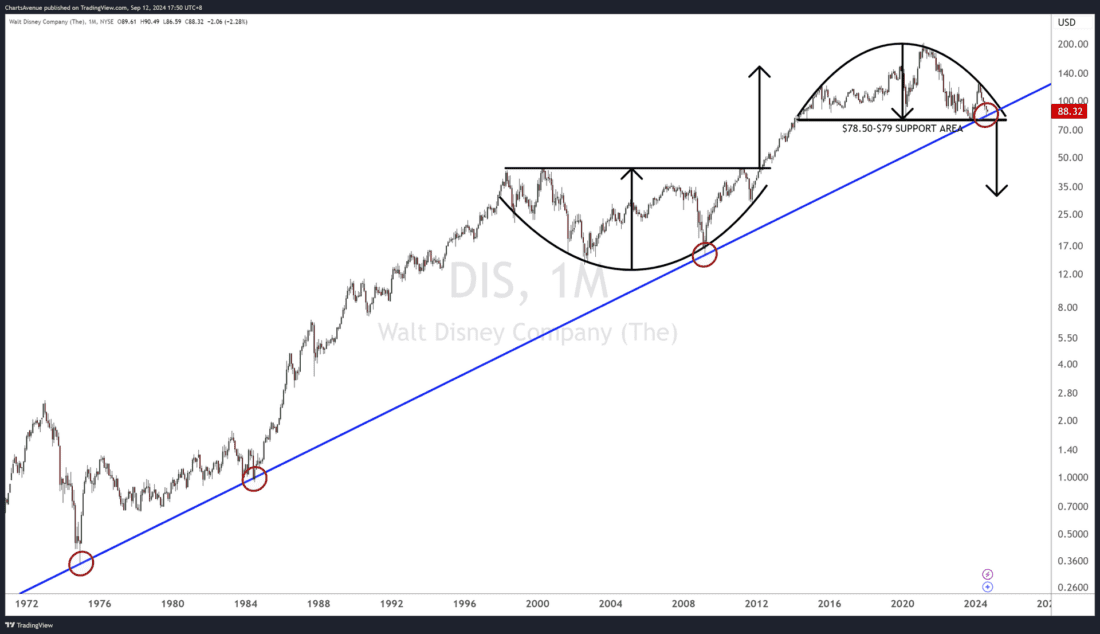

Prime Time for Disney

Disney is currently at a very interesting junction.

Last month, the price was able to bounce off an uptrend line in place since the price made a low in 1974 (you read correctly). The stock bounced off this uptrend support on another 3 occasions, twice in 1984 and once again in 2009. This could suggest that the cyclical decline is over and structural uptrend can resume.

At the same time, the price action over the last 10 years (remember, this is a monthly chart, we are looking at the long-term picture) created a rounding top pattern, which, if completed, i.e. the price breaks below the $78.50-$79 support area, could extend the decline since its March 2021 price high, sending the stock at levels not seen since 2011!

Past performance is not indicative of future results

As the price is still trading above its long term trendline support, the structural uptrend is given the benefit of the doubt.

—

Originally posted 13th September 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account