1/ Surprisingly, Little has Changed

2/ Euro in the Zone

3/ Bad News Bank Bears

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

Surprisingly, Little has Changed

At times, the price action in the markets tells you more about what is going on than the news headlines surrounding it. When news implies that the market should go one way, but market prices do the opposite, it’s time to pay attention. It usually pays to believe what the market price is telling you.

For example, an investor might think that when ‘unprecedented’ military action takes place in a volatile region, that investors would display grave concern over the uncertainty this implies. Investors don’t prefer uncertainty, and they tend to sell out positions if they think the future of a bullish trend is highly uncertain.

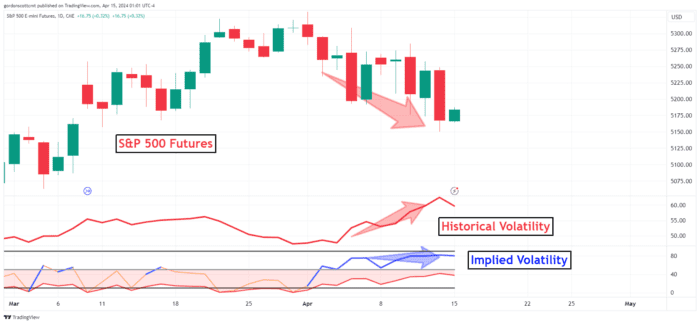

The downtrend in the S&P 500 Futures (ES) shown in the chart below are a good example of the uncertainty investors were sensing over the past two weeks. This didn’t just take place over the weekend after the headlines announced the drone strike from Iran.

Past performance is not indicative of future results

This downward trend was driven by growing uncertainty over a wide range of factors, not the least of which was a potential for Iran to take action. So now that the action has been taken, how is the market reacting? For now it seems as though investors are expecting things to proceed mildly, as ES futures stage a tepid rebound.

2/

Euro in the Zone

Even the currency markets displayed muted price action in the first few hours after markets opened in Australia and Japan. Though the price action in the hourly chart below shows a slight upward bias, the price has a long way to go to make up for losses from the days before.

Past performance is not indicative of future results

The lines on the chart above show two Keltner Channel lines market the measure of _1 and -1 Average True Range (ATR) over the last 12 hours. Here the EURUSD shows itself to be trading well inside this range, suggesting that, at least of the hour this was captured, just after 6:00 a.m. Greenwich Mean Time (GMT), markets were not ready to commit into a new direction. This suggests that investors don’t expect a military escalation in the near future.

3/

Bad News Bank Bears

That could change quickly when the U.S. markets begin trading. Even before this news, investors showed a very pessimistic response to the first official day of earnings season. All three of the major investment banks reporting Friday, Citigroup ( C ), J.P.MorganChase (JPM), and BlackRock (BLK), were subjected to a severe dose of selling.

Past performance is not indicative of future results

This news that accompanies these charts is that each of them beat estimates handily and showed increased profit margins through reduced expenses. Most investors would expect that this news should drive prices higher. But what we see instead tells us a lot more about what investors were thinking.

The prominent red candles indicate that investors feel more inclined to reduce exposure to these shares right now. If that doesn’t change before the markets begin trading in New York City, we are more likely to see continued selling though the day on Monday.

—

Originally posted 15th April. 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account