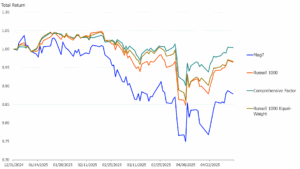

A colleague described yesterday’s showing by the stock market as “shaky.” That characterization was spot-on given that an opening rebound effort lost steam on the back of a softer-than-expected JOLTS – Job Openings Report for July. That report shook the soft landing tree, sending Treasury yields lower, the probability of a 50-basis points rate cut at the September FOMC meeting higher, and stocks fading for the most part into the closing bell.

Things continue to be shaky this morning.

Currently, the S&P 500 futures are down six points and are trading 0.1% below fair value, the Nasdaq 100 futures are down 71 points and are trading 0.4% below fair value, and the Dow Jones Industrial Average futures are up 14 points and are trading in-line with fair value.

The ADP report showed private-sector employment increased by 99,000 jobs in August. That was the lowest level of job creation in the private sector since 2021. The job gains were concentrated across medium-sized establishments (68,000) and large-sized establishments (42,000). Small-sized establishments showed a decrease of 9,000 positions.

Separately, initial jobless claims for the week ending August 31 decreased by 5,000 to 227,000 (Briefing.com consensus 236,000) while continuing jobless claims for the week ending August 24 decreased by 22,000 to 1.838 million. That is the 13th consecutive week that continuing claims have been above 1.800 million.

The key takeaway from the report is that layoff activity remains relatively tame; however, so does hiring activity, evidenced by the elevated stickiness of continuing jobless claims.

The 2-yr note yield, at 3.76% before the ADP release at 8:15 a.m. ET, dropped to 3.71% and is at 3.73% now. The 10-yr note yield, also at 3.76% before the ADP data, dropped to 3.73% and remains there.

The equity futures market gyrated in the wake of the employment reports, which were accompanied by the revised Q2 Productivity report, which showed productivity revised up to 2.5% (Briefing.com consensus 2.3%) from the preliminary reading of 2.3%. Unit labor costs were revised down to 0.4% (Briefing.com consensus 0.9%) from the preliminary reading of 0.9%.

The key takeaway from the report was the friendly inflation view embedded in the softening unit labor costs. They were up just 0.3% over the last four quarters, which is the lowest rate since the fourth quarter of 2013.

What the Fed does with this information remains to be seen. The probability of a 50-basis points rate has remained fairly steady at 45.0%, versus 44.0% yesterday, according to the CME Fed Watch Tool. That is unlikely to be a static number today given that the ISM Services PMI for August (Briefing.com consensus 51.0%; prior 51.4%) will be released at 10:00 a.m. ET.

In the meantime, market participants will pre-occupy themselves with deliberations about the labor market, the news of Dow component Verizon (VZ) making a $20 billion, or $38.50 per share, cash offer to acquire Frontier Communications Parent (FYBR), and press reports covering Vice President Harris’s proposal to increase the all-in top capital gains tax rate to 33% versus the current rate of 23.8%.

They will also pre-occupy themselves with the price action, just like they did yesterday, waiting to see if a stronger rebound effort can take root or if the bullish bias running into September continues to be uprooted.

—

Originally Posted September 5, 2024 – A shaky market

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Briefing.com and is being posted with its permission. The views expressed in this material are solely those of the author and/or Briefing.com and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account