I apologize for the seemingly cursory nature of today’s piece. I have a commitment that will take me out of the office this morning, so I will instead focus on a few key points:

- Middle East tensions: They’re certainly not good for markets by any means, but it’s important to keep in mind that equity markets are not particularly good at discerning the impact of geopolitical events on stock prices. Remember, investors are very good at figuring out how news events might affect revenues, earnings, cash flows, etc., but that’s very tough to do for the vast majority of stocks when it’s events halfway around the world. Instead, I look to bonds, where there is indeed a flight to safety bid, and oil, which is up modestly, but by no means panicky.

- Dockworkers strike: Also, not good news, but not having a huge impact yet. Fedex (FDX) and UPS caught bids yesterday on hopes that they will benefit, but they’re giving much back today. And Walmart (WMT) is up, which is counterintuitive if imports are impacted.

- Economic reports: Is good news bad again? On an early September media appearance I asserted that good news was good and bad news was bad because it was clear we were getting rate cuts at the next meeting no matter what. And we did, bigger than many expected. Now we’re quibbling over the magnitude of subsequent cuts, about which Powell is trying to tamp down expectations. So, when we think about this morning’s selling after mostly better than expected numbers, we seem to have switched again. JOLTS up and ISM prices down are good news for both ends of the dual mandate. But that means 25bp, not 50bp….

- It is very hard for the S&P 500 (SPX) to escape the gravitational pull of Apple (AAPL) & Microsoft (MSFT). But it’s clear that at least a piece of the decline is simply giving back the end of quarter pump that we saw yesterday, since the Midcap (MID) and Russell 2000 (RTY) indices are also down similar to SPX. Consider where we were prior to the Iran story and economic data. At that point, we had simply given back the last 20 minutes of yesterday, which was clearly “mark the close” activity:

Source: Interactive Brokers

Past performance is not indicative of future results

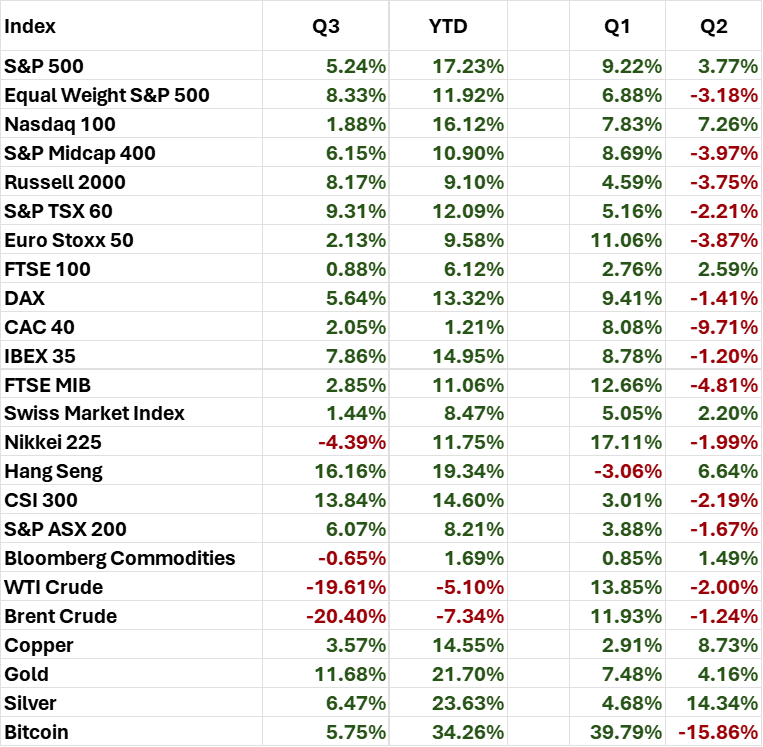

- I literally just finished this table, which puts both 3Q and YTD in perspective.

Source: Interactive Brokers

Past performance is not indicative of future results

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account