What’s going on here?

US stock futures dipped slightly as investors eagerly awaited the Commerce Department’s personal consumption expenditure (PCE) index report for August, anticipated to show a 2.3% rise, down from 2.5% in July.

What does this mean?

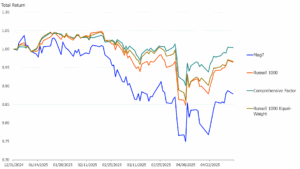

The Federal Reserve’s recent 50 basis point rate cut marks the beginning of a policy easing cycle aimed at stabilizing employment. With the Fed now more focused on job stability rather than just inflation, strategists at ING Bank believe market reactions to inflation data may be muted. The CME Group’s FedWatch Tool reflects a 50.8% chance of another significant Fed move in November, keeping investors on their toes. Meanwhile, Wall Street remains optimistic, with the S&P 500, Dow, and Nasdaq poised for their third consecutive week of gains.

Why should I care?

For markets: Tuning into new signals.

With the Fed’s pivot towards maintaining stable employment, markets may experience less volatility from inflation data. But don’t get too comfortable: the probability of another significant rate change in November is over 50%, suggesting that pivotal shifts in policy are still in play.

The bigger picture: Optimism and caution in the air.

Beyond the PCE index, several factors are creating a dynamic market environment. While shares of Bristol Myers Squibb surged 6% after FDA approval of its new schizophrenia drug, others like Costco and Dollar General are struggling due to cautious consumer spending and analyst downgrades. Plus, gains in US-listed shares of Chinese firms and miners reflect positive sentiment driven by China’s economic policies.

—

Originally Posted September 27, 2024 – US Futures Dip As Investors Anticipate Key Inflation Report

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account