Originally Posted, 23 September 2024 – Monthly Cash Review – GBP State Street GBP Liquidity LVNAV Fund, August 2024

In a decision that was described as “finely balanced”, the Bank of England’s (BoE) Monetary Policy Committee (MPC) voted 5-4 at its meeting on 1 August to cut the base rate from 5.25% to 5.00%. MPC members Bailey, Breeden, and Lombardelli joined Dhingra and Ramsden in voting to lower rates for the first time since March 2020.

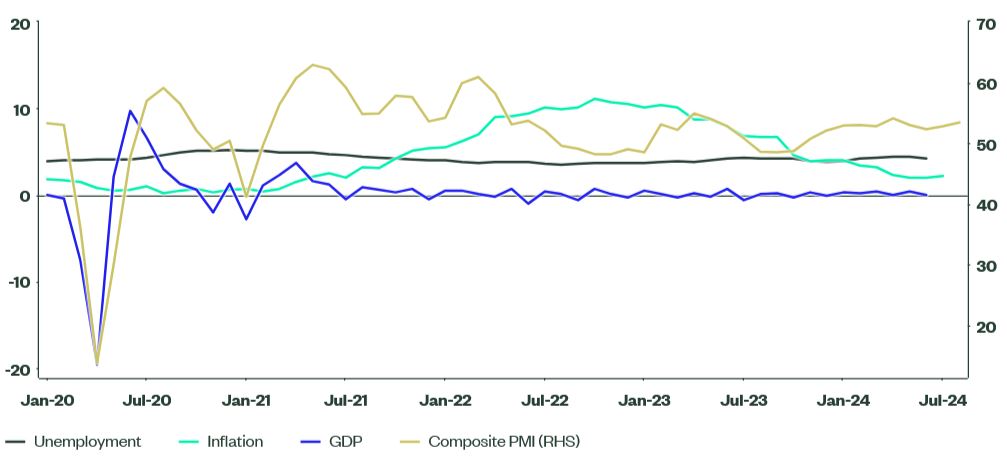

Economic Data

- Headline inflation rose from 2.0% in June to 2.2% in July, although the outcome came in lower than consensus expectations of 2.3%. An increase was expected given the energy base effects from the Ofgem price cap which kicked in on 1 July. Core inflation fell from 3.5% in June to 3.3% in July versus consensus expectations of 3.4%. Services inflation declined more than anticipated from 5.7% to a two-year low of 5.2%, below the BoE forecast of 5.6%.

- GDP for June was 0.0%, in line with expectations. Although services activity fell by 0.1%, industrial production rose by 0.8 and construction output increased 0.5%.

- GDP growth for Q2 2024 was reported at 0.6%, marginally lower than BoE expectations of 0.7%. Private consumption was softer than expected, although this was offset by stronger government spending.

- The composite purchasing managers’ index (PMI) rose from 52.8 in July to 53.4 in August, above consensus expectations of 52.9. Readings above 50 are indicative of economic growth. The uptick was driven by services (53.3, +0.8), while manufacturing output eased to 54.2 (-0.7).

- The unemployment rate declined from 4.4% to 4.2% versus consensus expectations for a small increase to 4.5%. Private sector pay growth, a focus for the BoE, declined from 5.6% to 5.2% — which was only marginally above the BoE forecast of 5.1%.

Outlook

The tone of the MPC meeting minutes, Monetary Policy Report (MPR), and press conference was cautious across the board. In its forward guidance, the MPC added that policy would remain restrictive for sufficiently long “until the risks to inflation returning to the 2% target had dissipated further”. Governor Andrew Bailey said that “we need to be careful not to cut rates too quickly or by too much”. Updated inflation forecasts saw a downward revision — the level is now expected to be 1.7% at the two-year horizon and 1.5% at the three-year horizon. The projection for GDP was revised higher in the near term, but there was no material change to the medium-term growth outlook. The MPC stated that it “will decide the appropriate degree of monetary policy restrictiveness at each meeting”.

The MPC would appear to want to see more evidence of declining inflationary pressures before implementing further rate cuts. The 10% rise in the Ofgem utility price cap on 1 October means that inflation for November is expected to increase. Another aspect is public sector pay deals that have outpaced inflation. While this is not expected to be inflationary on its own, there is a concern that this sets a benchmark for private sector firms, with wage and services inflation then remaining elevated. The main driver behind interest rate decisions is likely to be linked to services inflation, but the risk is more to the upside. From an economic data perspective, PMI data for August suggests GDP growth for Q3 2024 will slow from 0.6% in Q2 to a rate of around 0.3%.

Chancellor Rachel Reeves has revealed a £22bn black hole in the government budget for this year, following an audit by HM Treasury. A part of this relates to the increase in pay for public sector workers — this had previously been set at 2% but is now increased to between 5% and 6%. Reeves immediately cut back on some planned spending with an expectation of saving £5.5bn this year. The shortfall is expected to be funded by tax increases announced at the first budget of the new government, which is scheduled for 30 October.

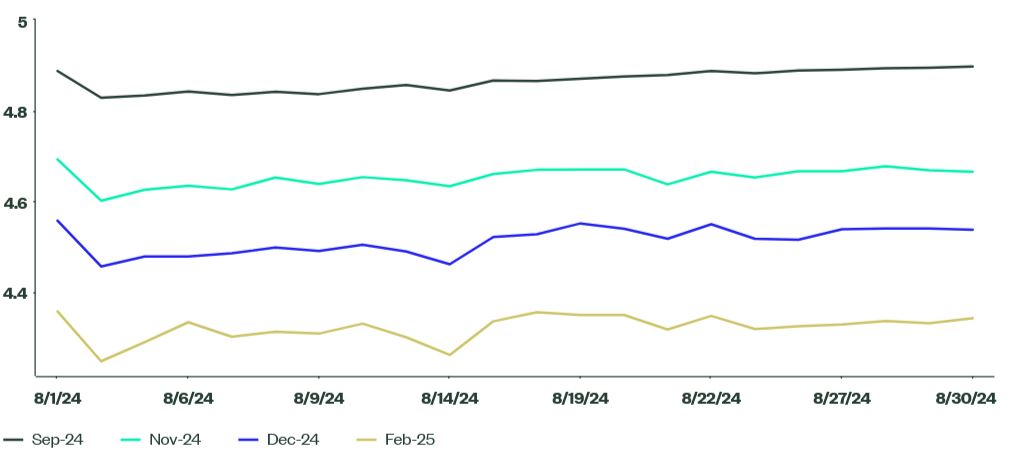

Market implied rates (Figure 1) for September finished August at 4.90%, suggesting that rates are more likely to be maintained at the next meeting. However, the implied rate for November of 4.67% shows that the market has fully priced in a rate cut. The year-end implied rate also moved lower to 4.54%, suggesting the expectation of another interest rate cut.

Figure 1: Market Implied interest Rate Expectations

Source: Bloomberg Finance LP as of 30 August 2024 – Forecast are based upon estimates and reflect subjective judgments and assumptions. There can be no assurance that developments will transpire as forecasted and that the estimates are accurate. Past performance is not indicative of future results.

Fund

Yields for GBP investments moved lower following the interest rate cut on 1 Aug. Market expectations are that rates will be maintained at the September MPC meeting, with a cut to follow in November. With the fund’s weighted average maturity (WAM) already in the mid-40 day duration range, limited additional term trades were added to take advantage of higher yields offered at the time. Investments during August were mostly kept short, within a one-month duration. Fund liquidity requirements, both overnight and weekly, were well in excess of minimum requirements at all times. Fund liquidity was covered with a combination of government and supranational holdings, gilt repo and bank deposits. The fund credit rating exceeded requirements at all times.

Figure 2: A Snapshot of UK Economic Data

Source: Office for national Statistics and Bloomberg Finance LP as of 30 August 2024 – Past performance is not indicative of future results.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account