Originally posted 20 Jan 2025 – Looking back at equity factors in Q4 2024 with WisdomTree

Key Takeaways

- US equities lead: in 2024, US equities outperformed, driven by robust corporate earnings and supportive fiscal policies.

- Growth factor dominance: Growth stocks maintained their lead, particularly in the US (for a second year in a row), though elevated valuations raised doubt on a possible trifecta for 2025.

- Factor diversification: focusing on Value, Growth and Quality could be the key to defend against possible instability in the year ahead.

Looking back at 2024, global equity markets remained resilient despite a challenging final few weeks. US equities led both annually and quarterly, buoyed by robust corporate earnings, supportive fiscal policies, and market optimism following the Republicans’ red sweep in November. In contrast, European and emerging markets exhibited more modest performances, influenced by political uncertainties.

From a factor perspective, Growth stocks maintained their leadership, particularly within the US market. However, concerns regarding elevated valuations persist, prompting discussions about the sustainability of this trend.

This instalment of the WisdomTree Quarterly Equity Factor Review examines how equity factors behaved during the fourth quarter and their potential impact on investors’ portfolios.

Performance in focus: back to Growth

Equity markets stalled in the latter half of Q4 2024 after a strong start, leading to negative performances across most regions. The MSCI Emerging Markets Index declined by 8%, as trade war concerns and a weak Chinese economy weighed on sentiment. Political instability in South Korea and Europe, notably in France and Germany, contributed to the MSCI Europe Index’s 2.7% loss. US equities proved most resilient, supported by Donald Trump’s victory and two rate cuts in November and December, closing the quarter with a 2.7% gain1.

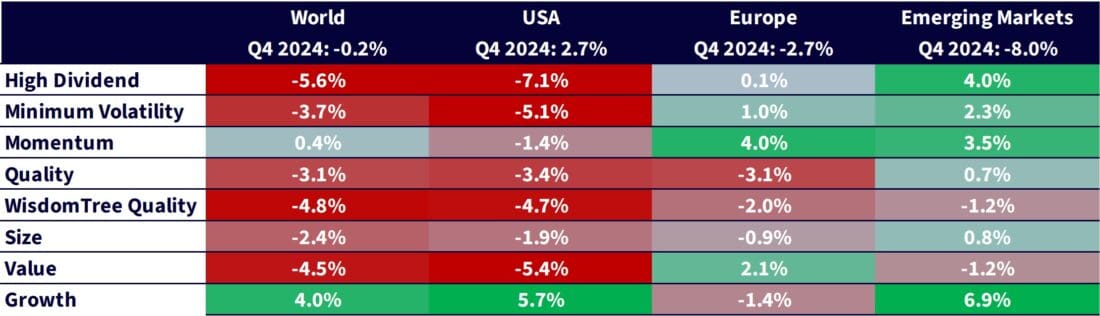

On the factor front, the Q3 rotation faded quickly:

- Growth posted the strongest returns in most regions (US, Developed World, and Emerging Markets).

- Europe stood out, with Momentum and Value dominating over the quarter.

- Quality continued to suffer across all developed markets, extending the Q3 trend.

- In the US, Value and High-Dividend stocks experienced significant underperformance, impacting world equities due to the US’ substantial weight.

- Size also underperformed in developed markets but to a lesser degree.

- In Emerging Markets, High Dividend performed well, solidifying its position as a medium- to long-term leader. Momentum and Minimum Volatility also showed notable performances.

Figure 1: Equity factor outperformance in Q4 2024 across regions

Source: WisdomTree, Bloomberg. 30 September 2024 to 31 December 2024. Calculated in US dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in value.

2024 in review: another growth year

Despite a weaker Q4, 2024 was strong for equities. Central banks initiated easing cycles, inflation receded, and corporate earnings remained robust, defying early-year predictions of slowdowns or recessions. The US achieved the strongest gains at 24.6%, while Europe (8.6%) and Emerging Markets (7.5%) lagged.

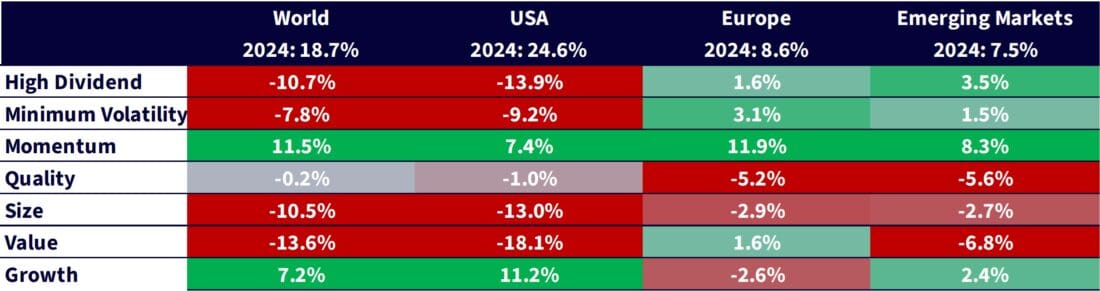

Factor-wise, while the year was less uniform than 2023, Growth dominated, especially in the US:

- Growth posted the strongest return in the US and top-three finishes in Developed and Emerging Markets.

- Momentum was a standout in World, Europe, and Emerging Markets, driven by an exceptional first half of 2024.

- In the US, Value underperformed the most, followed by High Dividends.

- In Europe, Quality had the worst returns, with Size and Growth just behind.

- Notably, Quality experienced one of its worst performances in years, underperforming across all regions.

- In Emerging Markets, High Dividend continued to perform well, finishing second for the year with a 3.5% outperformance.

Figure 2: Equity factor outperformance in 2024 across regions

Source: WisdomTree, Bloomberg. 31 December 2023 to 31 December 2024. Calculated in US dollars. Historical performance is not an indication of future performance and any investments may go down in value.

Growth in the US is becoming expensive

In Q4 2024, US market valuations increased, with the price-to-earnings (P/E) ratio rising by 0.7. Growth stocks became even more expensive, with the P/E ratio climbing by 4.4 to 38.8. Years of dominance have led to high valuations for major growth names. In Europe and Emerging Markets, valuations declined, with overall valuations appearing inexpensive by historical standards. Value and High Dividend stocks are priced at P/E ratios of 10 or lower.

Figure 3: Historical evolution of Price to Earnings ratios of equity factors

Source: WisdomTree, Bloomberg. As of 31 December 2024. Historical performance is not an indication of future performance and any investments may go down in value.

Looking forward to 2025

2024 marked a second year of Growth dominance. However, market behaviours differed, with Momentum posting the second-best results, unlike Quality’s second-place finish in 2023. As we look to 2025, while maintaining a constructive view on equities, concerns about Growth stock valuations persist. Investors may benefit from diversifying factor exposure across Growth, Value, and Quality, anticipating multiple micro factor rotations.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index.

Momentum is proxied by the relevant MSCI Momentum net total return index. High Dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index. WisdomTree Quality is proxied by the relevant WisdomTree Quality Dividend Growth Index.

1 WisdomTree, Bloomberg. 30 September 2024 to 31 December 2024.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Mutual Funds

Not all funds are available to retail investors. Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds' assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please visit the Mutual Funds section of your local Interactive Brokers website.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account