Wall Street Horizon conducted its annual online survey focused on data for trading and risk in June 2024. The majority of respondents were executive level at institutional firms, traders/investors, and portfolio managers. The firms they represented included institutional quantitative and discretionary fund managers, individual investors and trading/research platforms.

Key findings from the survey results include:

- Earnings announcements and earnings announcement changes ranked as the top two corporate event types that survey respondents considered to be most important to follow

- Approximately 24% of respondents experienced a loss due to an earnings date that was missing, incorrect or had changed

- Out of the 24% that suffered a loss, 50% said a poorly timed investment resulted, 17% said the loss impacted a trading strategy, and 17% indicated it affected a risk strategy

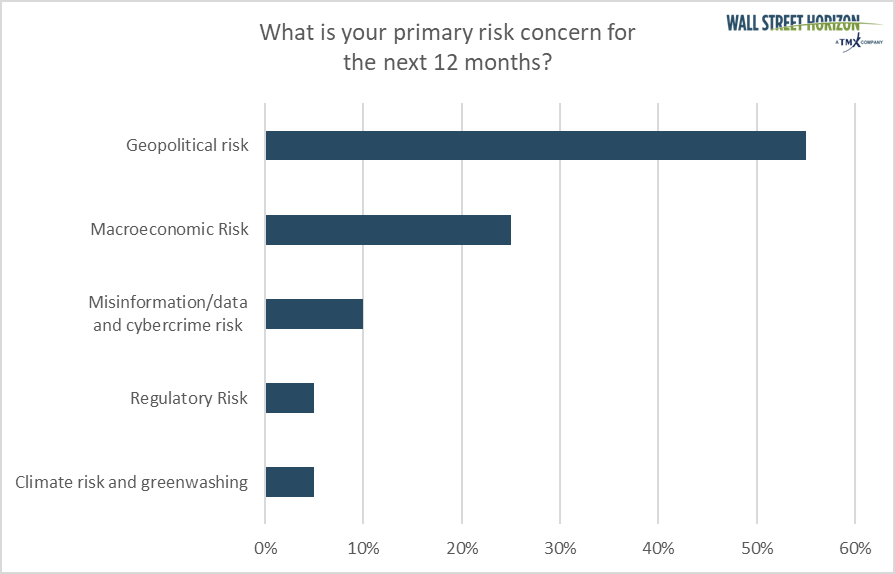

- Geopolitical risk was the primary risk concern (55%) followed by macroeconomic risk (25%)

Earnings announcement data has been reported by survey respondents as the top corporate event type to track since the survey’s inception in 2017. As Figure 1 shows, the top 5 event types to track in 2024 included: earnings announcements, earnings announcement changes, M&As, dividends, and investor/analytics events.

The most significant change from last year is the increase in the importance of earnings announcement changes, as reported by survey respondents, as investors appear to be even more savvy by recognizing that earnings announcement dates and their changes can serve as volatility catalysts.

Figure 1, 2024 Survey. Source: Wall Street Horizon

Past performance is not indicative of future results

In 2024, 24% of respondents experienced a loss because an earnings date was missing, incorrect or had changed. This is a significant drop from last year’s 47%.

Figure 2, 2024 Survey. Source: Wall Street Horizon

Past performance is not indicative of future results

Of the 24% of respondents who reported a loss because of an incorrect or changed earnings date, what was the result? Fifty percent responded that a poorly timed investment resulted, 17% said it impacted a trading strategy and 17% indicated it affected a risk strategy.

Of note related to earnings announcement timing is the Wall Street Horizon Late Earnings Report Index (LERI). The LERI is a proprietary metric that tracks the number of off-trend earnings date confirmations reported later or earlier than their historical average at US publicly traded companies with market capitalizations of $250M and higher. A reading over 100 demonstrates that more companies are delaying earnings reports, which should be watched carefully. The official post-peak season LERI reading for the Q2 reporting season (data collected in Q3) stands at 186, an increase from 157 in Q1 of 2024. View press release: Wall Street Horizon LERI (Late Earnings Report Index) Shows Less US Corporate Confidence.

Risk seems to be of concern for respondents, which may be due to macro factors such as the upcoming US election, unrest in the Middle East and regulatory changes. As shown in Figure 3, survey participants flagged geopolitical risk (55%) as the primary risk concern followed by macroeconomic risk (25%) and misinformation/data and cybercrime risk (10%). By contrast, in the 2023 survey, the top two risk concern results were flipped, with macroeconomic risk as the primary risk concern (41%) followed by geopolitical risk (35%). This isn’t surprising as investors this year may be concerned with the US election, especially given the unexpected democratic candidate shift in July 2024.

Figure 3, 2024 Survey. Source: Wall Street Horizon

Past performance is not indicative of future results

With AI attracting the attention of many investors, we asked how concerned survey respondents are about the regulatory risk posed by the use of AI within the investment process. The majority (57%) reported concern with 24% reporting not concerned. Of note, Wall Street Horizon conducted the same poll during our April 2024 Data Minds panel “Triple Threat: Leveraging Data to Manage AI, ESG, and ETF Risks” and interestingly had the same percentage of respondents (57%) reporting concern (plus an extra 13% voted extremely concerned) and only 4% were not concerned. The webinar addressed the ever important question: Given the increased regulatory focus on AI usage, what specific risks will firms face when it comes to data selection and usage? View recording.

Finally, the survey included an open ended question pertaining to the most prominent pain point in the corporate event space. Accuracy and completeness of the data from providers, including addressing gaps between multiple providers, was the most prevalent response. This feedback is not new for the Wall Street Horizon team, therefore we follow a strict methodology of automated and hand curated data collection. Additional notable write-in responses include pricing concerns, the challenge of keeping up with events, and lack of coverage on small cap stocks. Wall Street Horizon has addressed the latter concern with its recent release of expanded small cap coverage in its Global Events Calendar offering, more info here.

—

Originally Posted August 29, 2024 – Key Findings 2024: Data for Trading and Risk Annual Survey from Wall Street Horizon

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Wall Street Horizon and is being posted with its permission. The views expressed in this material are solely those of the author and/or Wall Street Horizon and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account