Originally Posted, 20 August 2024 – Insights into the Japanese equities market sell-off

Junichi Inoue, Head of Japanese Equities, discusses the multiple triggers that led to the recent sharp market sell-off.

Insights into the Japanese equities market sell-off – Janus Henderson Investors

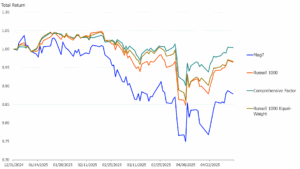

On August 5th 2024, the Nikkei 225 Index saw the second largest drop in its history. The largest drop was on Black Monday in 1987, followed by the 2008 Global Financial Crisis (GFC) in third place, the 2011 Great East Japan Earthquake in fourth, and the 1953 Stalin crash in fifth. But how will the recent 12% one-day drop be remembered in the future? Could it be known as the Bank of Japan (BoJ) rate-hike shock? The timing of the second hike was two months earlier than the market predicted, but followed a predetermined course, and the second hike was lower, at only 15 basis points.

Unexpected scale and speed of yen carry trade unwinding

Currently, the most supported headline explanation for the massive drop by market commentators is the unwinding of the yen carry trade. However, it’s difficult to clearly capture the scale of the yen carry trade and its main participants. One securities company claimed that all trades have been unwound, while another stated only 30% has been unwound. The reality is that the true extent of the yen carry trade is unknown because most foreign exchange (FX) trading is still executed over-the-counter (OTC), meaning trading data is less available and reliable. And for the most part only commodity trading advisors (CTAs) use FX futures, which have more transparency since they’re regulated and traded on the open market.

For now, the immediate panic is over. The majority of CTA and momentum-driven investors’ positions appear to have been closed out (yen short positions in FX futures have been covered and speculative yen positions are now flat). This means that the FX impact on profits earned by Japanese companies overseas have largely been minimised.

Overseas profits are not being repatriated and converted into yen

A visit last month to an exporting company that earns most of its profits in the US provided some interesting insight. The CFO revealed that the company had not repatriated any profits earned in the US over the past three years. Dividends and share buybacks were financed with low-interest yen, while interest earned on their profits came from parking these funds in time deposits in the US, which amounted to a few trillion yen. Many companies like this hold US dollar deposits equivalent to a single FX intervention. Additionally, the interest and dividend income earned overseas by Japanese institutional investors is generally reinvested in local currencies. However, extreme yen depreciation and an aging population could lead to yen conversion. In our view, this broader definition of the yen carry trade is overlooked in the structurally weak yen theory.

Market overwhelmingly calling for yen depreciation

We also think that another factor that led to the market correction is the homogenisation of investment behaviour. For example, the yen had been trading at historical levels of deviation from purchasing power parity rates, presenting a level of undervaluation comparable to just before the Plaza Accord was signed in 1984 (which is believed to have contributed to the Japanese price asset bubble in the late 1980s). Despite this, the yen continued to weaken against the backdrop of the Japan-US interest rate differential, and calls for yen appreciation were overcome by structural yen depreciation theories.

AI-fuelled boom driving crowded trades

Also, the semiconductor manufacturing equipment sector in Japan was a crowded trade, riding on the coat-tails of the AI-related stock boom. While many of these companies undoubtedly possess competitive strengths, many were trading at stretched valuations (prices). Related to this, the market-wide success of trend-following investment strategies over time has made investing with a valuation discipline more challenging. This set the stage for a correction, with market sentiment already fragile due to sharp falls in AI-related stocks in the preceding weeks, and the US Federal Reserve’s decision to hold rates at high levels even as US employment data was beginning to weaken rapidly.

Against this backdrop, the confluence of the above-mentioned triggers and weeks later, the Bank of Japan’s end July rate hike, which (for some) came as a surprise in terms of timing, led to a massive sell-off, especially in those stocks that had made strong year-to-date gains. Many hedge funds with high leverage and a low pain threshold for losses (and where they also operate on a calendar year profit & loss) were forced to liquidate leveraged positions quickly, exaggerating the size of the moves. This episode exposes the dangers of betting on trends rather than focusing on company fundamentals like earnings and valuations.

Yen appreciation can be a positive

Looking forward, following the yen’s correction, the market is more wary towards a one-sided bet on yen depreciation. Structural theories on Japan’s trade deficits are highlighted, but the current account surplus is currently at a record high, while interest rate differentials are shrinking. Further, an appreciating yen could, in fact, lower input costs and help curb inflation. We believe it may also reduce corporate margin pressure, and lead to sustained wage increases. Should this scenario play out, the BoJ can conduct monetary policy based on inflation rates without being swayed by exchange rates. Although yen appreciation is in theory a negative for exporters’ performance, the stock market didn’t discount this factor in their stock valuations when the yen-US spot rate hit 160. Therefore, the impact on the market’s view of fair value of below 150 could be limited – the recent market drop has seen the yen fall well below this level.

Volatility-created opportunities

On a positive note, we see opportunity amid the recent volatility. The rapid movement in capital markets has reduced the market’s risk tolerance; leading to a more cautious market and reconsideration of one-way bets on yen depreciation. Meanwhile, a transformation of corporate governance and capital efficiency is underway in corporate Japan, which we believe is in the process of unlocking substantial hidden value for investors. While we expect continued volatility in the short term, the recent drop has enabled us to identify many mispriced stocks.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

Marketing Communication.

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account