Originally Posted 22 January 2025 – Inflation, tariffs, and other investor questions answered

Key takeaways

US inflation

My base case remains that US disinflation will continue, but I’m closely watching signs of a potential resurgence in inflation.

Tariffs

It’s possible that we may see tariff threats used as a tool to achieve other policy goals without actual implementation of significant tariffs.

Chinese economy

I believe China’s fourth-quarter growth is sustainable, and largely due to significant stimulus from policymakers.

Investors around the world are focused on some key questions regarding the path of US inflation, the possibility of tariffs, the progress of the Chinese economy, and policies regarding bitcoin. Not to mention some unusual (but not unprecedented) moves in the US 10-year Treasury yield. Here, I address some of the most common questions I’ve gotten from clients since the start of the new year.

Will US inflation rise from here?

My base case remains that disinflation will continue as very restrictive monetary policy has helped normalize the US economy. I expect disinflationary progress to be imperfect, as it was in 2024, with periods of significant reduction in inflation and other periods with little or no reduction.

However, I am concerned about signs of a potential resurgence in inflation.

- The December ISM Services Purchasing Managers’ Index showed that the prices paid sub-index increased substantially from 58.2 in November to 64.4 in December; this is the highest reading since February 2023.1

- A stronger global economy, especially in China, could increase demand for commodities, which could increase inflation.

- Policies coming from the new Trump administration could amplify inflationary pressures, although I am far more concerned about an extreme deportation policy than I am about tariffs in terms of their impact on inflation.

We will have to watch the situation closely.

Should investors be worried about tariffs?

When tariffs were implemented in 2018, they caused the S&P 500 Index to experience higher volatility and end the calendar year lower. They caused even more damage to other markets. However, this time around seems like it could be different — there may be more use of tariff threats as a tool to achieve other policy goals and less implementation of actual tariffs. In any event, tariffs had a very temporary impact on the stock market in 2018, so I would not expect new tariffs to impact investors beyond very short time horizons.

What’s going on with the 10-year US Treasury yield?

The 10-year US Treasury yield has risen about 100 basis points since the US Federal Reserve (Fed) began cutting rates in September. On Sept. 17, the yield was 3.7%, but that rapidly climbed to 4.79% on Jan. 13.2 It’s unusual to have long yields rise once the Fed starts to cut rates, which has some investors scratching their heads.

However, there is precedent for this if we go back to the 1990s. In 1995, the 10-year US Treasury yield was 6.19% on July 5, the day before the Fed decision to cut rates. By Aug. 23, it had climbed to 6.6% before starting to ease.3 This period was unique in that it followed the last time the Fed was able to tighten rates but avoid a recession. I’ve mentioned for some time that the current period has been analogous to the mid-1990s in several different ways; the rise in the 10-year yield is just one more similarity.

Will the 10-year US Treasury yield reach 5% or higher?

To prognosticate on where the 10-year US Treasury yield will go, it’s important to discuss which factors impact the yield. Theory suggests that the 10-year US Treasury yield is determined by expected short rates, which includes inflation expectations and growth expectations and therefore Fed expectations, plus a term premium, which is the compensation investors require to hold a bond with a longer maturity. The term premium is quite amorphous and is impacted by a variety of factors, including Treasury supply and demand dynamics – a broad category that encompasses a number of components, including quantitative easing and tightening as well as expectations around fiscal deficits.

Yields can move rapidly, as we saw this past fall, as factors influencing the yield can be quickly impacted by data and even “Fedspeak.” Just look at the 10-year US Treasury yield’s move last week, from Monday’s peak of 4.79% to Friday’s close of 4.61%.4 That was a result of lowered inflation expectations in response to the December core Consumer Price Index reading and some dovish comments from Fed officials.

Because I believe there will be more disinflationary progress this year, I don’t believe the 10-year US Treasury yield will climb much higher – unless concerns about the fiscal deficit grow and bond vigilantism takes hold. This of course will depend on the Trump administration’s policy agenda this year – whether it’s focused on tax cuts or government cost cuts. Having said that, my base case is that the 10-year yield won’t pierce 5% this year. although I do think we will see some volatility in the yield given elevated uncertainty. I do think there could be periods where concern over fiscal deficits moves the yield higher, but not dramatically higher.

Will global government bond yields also move higher?

Developed economies’ government bond yields have largely moved in the same direction, and I expect that correlation to hold. I do expect some anomalies in terms of individual relationships; for example, the Greek 10-year bond yield was eclipsed by the French 10-year bond yield last year as a result of specific political and fiscal issues for France. I expect those types of anomalies to continue as “core” eurozone economies continue to feel pressure while peripheral eurozone economies perform relatively better.

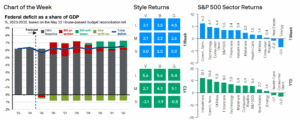

What will happen to the US stock market this year?

I believe we’re likely to see a rise in the US stock market this year, for a number of reasons.

- As mentioned earlier, I believe the 10-year US Treasury yield will not climb much higher and is likely to ease somewhat this year, which should take pressure off stocks.

- I also anticipate earnings will improve this year, helping to provide support for stocks. For calendar year 2025, Wall Street analysts are forecasting earnings growth of 14.8% and revenue growth of 5.9%.5

- I also believe stocks globally will perform well, given a broad environment of monetary policy easing and what is likely to be a re-acceleration in global growth.

What will happen to the Chinese economy this year?

China had a strong fourth quarter, as evidenced by its gross domestic product growth of 5.4% year-over-year.6 China’s industrial production grew by 6.2% year-over-year in December 2024, surpassing expectations and its November growth rate of 5.4%.7

It’s important to note that this was China’s fastest pace in industrial output growth since April. Some might argue that this is largely the result of a “pull forward” of purchases in advance of potential tariffs from the Trump administration and is therefore unsustainable. But I believe this is largely a result of the very significant stimulus coming from Chinese policymakers and that it is very sustainable.

In terms of tariffs, I’m becoming more confident that the new Trump administration is thinking of tariffs as a means to an end rather than an end, which suggests we may not see implementation of any significant tariffs on Chinese goods – or any goods. Tariffs could be used to achieve policy objectives such as immigration reform (i.e., threats to tariff Mexican goods if Mexico does not cooperate with US immigration policy) and purchase of US goods (i.e., threats to tariff European goods if the European Union does not buy more US energy). There is some precedent for this. During the Reagan administration, pressure on Japanese and German automakers to submit to “voluntary export restraints” led to the building of auto factories in the US, which still exist today and provide many jobs to US workers. I will of course be following the tariff situation closely.

Looking ahead

The Bank of Japan will meet this week and is increasingly expected to hike rates, which is causing some to be concerned about the potential market impact given what happened when it unexpectedly hiked in late July. However, a rate hike this week would not be a surprise, so I wouldn’t expect the same impact – and it should send a positive message that the Japanese economy continues to normalize. However, there is the potential that a hike this week could cause carry trade unwinds and some increased volatility. We will want to follow the situation closely.

Dates to watch

| Date | Report | What it tells us |

|---|---|---|

| Jan. 21 | UK Unemployment | Indicates the health of the job market. |

| UK Average Earnings Index | Measures wage growth for UK workers. | |

| Eurozone ZEW Economic Sentiment | Measures economic sentiment in the eurozone for the next six months. | |

| Canada Consumer Price Index | Tracks the path of inflation. | |

| Jan. 22 | Korea Gross Domestic Product | Measures a region’s economic activity. |

| Jan. 23 | Bank of Norway Monetary Policy Decision | Reveals the path of interest rates. |

| UK GfK Consumer Confidence | Measures the level of consumer confidence in economic activity in the UK. | |

| Bank of Japan Monetary Policy Decision | Reveals the path of interest rates. | |

| Jan. 24 | Eurozone Purchasing Managers’ Indexes | Indicates the economic health of the manufacturing and services sectors. |

| UK Purchasing Managers’ Indexes | Indicates the economic health of the manufacturing and services sectors. | |

| US Purchasing Managers’ Indexes | Indicates the economic health of the manufacturing and services sectors. | |

| University of Michigan Survey of Consumers | Provides indexes of consumer sentiment and inflation expectations. |

Footnotes

- 1 Source: Institute for Supply Management, Jan. 7, 2025

- 2 Source: St Louis Federal Reserve Economic Data, as of Jan. 17, 2025

- 3 Source: St Louis Federal Reserve Economic Data, as of Jan. 17, 2025

- 4 Source: Bloomberg, as of Jan. 17, 2025

- 5 Source: FactSet Research Systems, as of Jan. 17, 2025

- 6 Source: China National Bureau of Statistics, as of January 2025

- 7 Source: China National Bureau of Statistics, as of January 2025

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account