Originally Posted, 3 September 2024 – European Infrastructure: Investing for the Modern Age

Infrastructure is the backbone of a modern economy, as it provides the systems and networks that enable the efficient movement of people, goods, services, and information. In Europe, infrastructure sits at the intersection of several emergent priorities, including national security, supply chain independence, and energy efficiency. Secure and resilient infrastructure can be vital for safeguarding national interests and ensuring the ability to respond effectively to potential threats like the COVID-19 pandemic and the war in Ukraine. Robust infrastructure, particularly in manufacturing, logistics, and digital connectivity, can potentially reduce reliance on global supply chains and mitigate risks associated with disruptions. Additionally, energy efficient infrastructure can lower carbon emissions and help Europe strives towards its goal of carbon neutrality by 2050.

Recognising these intersecting priorities, European governments have launched ambitious investment programmes aimed at modernising and strengthening their infrastructure networks. The programmes encompass a range of assets, including transportation networks (roads, bridges, railways, airports), utilities (water, electricity, telecommunications), and social infrastructure (schools, hospitals, public spaces).2 These programmes can form the backbone of compelling opportunities, which the Global X European Infrastructure Development UCITS ETF (BRIJ) is designed to capture.

Key Takeaways

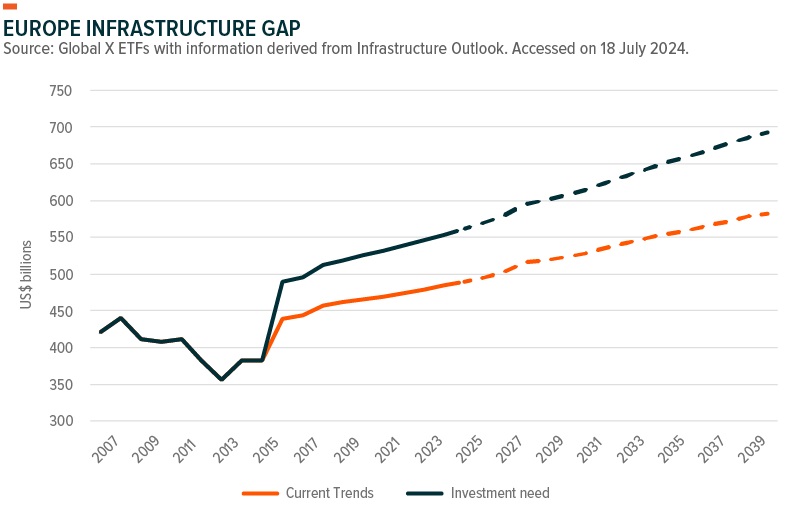

- Europe needs infrastructure investment. The G20’s Global Infrastructure Outlook estimates that the European infrastructure investment gap, calculated as the difference between the current trend in infrastructure investment and investment need, could reach US$2 trillion by 2040.3

- Major funding vehicles and policies such as NextGenerationEU, the Cohesion Policy, and the Connecting Europe Facility are aiming to help modernise infrastructure in four key areas: traditional infrastructure, infrastructure networks, clean energy infrastructure, and digital infrastructure.

- BRIJ differentiates itself from traditional infrastructure investing by using a pure-play approach with a focus on Europe. Through this approach, BRIJ aims to invest in companies which may benefit from pan-European initiatives that modernise and expand infrastructure in these four key areas.

Public Policies and Investments Seek to Close Europe’s Infrastructure Gap

Europe’s potential $2 trillion infrastructure investment gap by 2040 equates to an annual investment gap of 0.35% of GDP.4 While Europe’s gap is lower than the estimated $3.8 trillion gap in the United States, significant investment is required across the region’s infrastructure sectors.5

Past performance is not indicative of future results

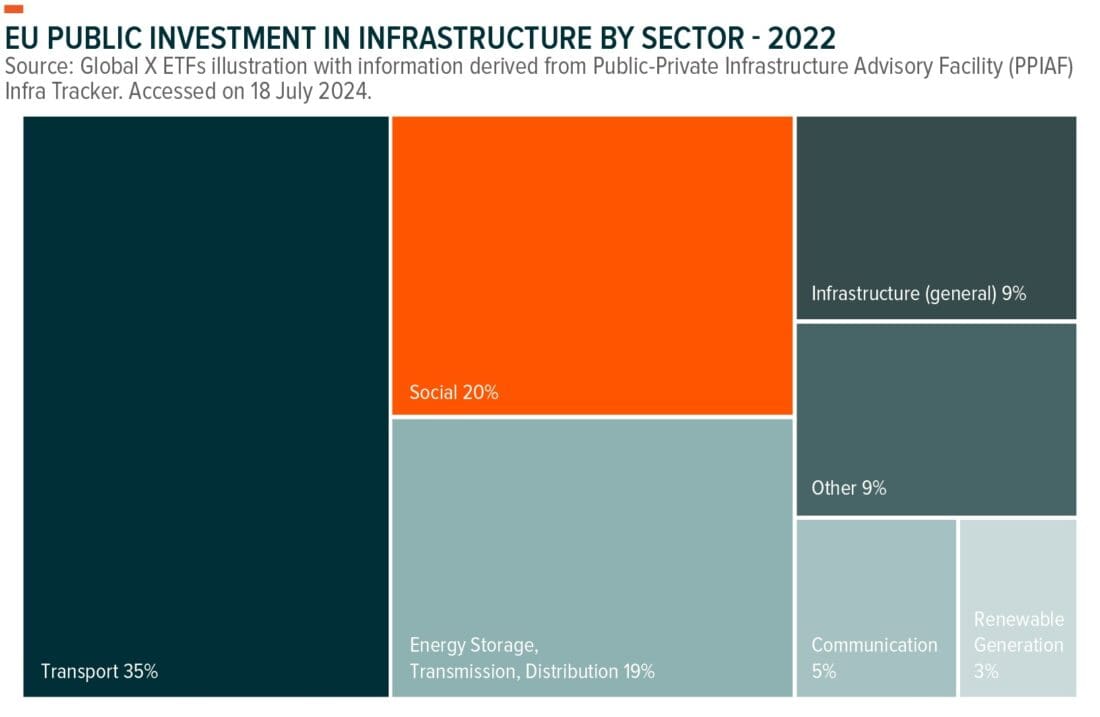

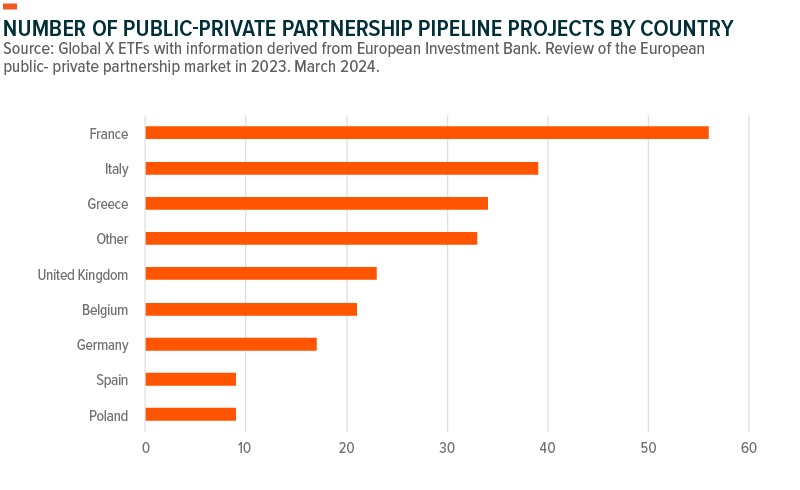

Public investment is well underway, with a strong pipeline of infrastructure projects.6 Based on the European Investment Bank’s (EIB) 2023 Market Update, transport is the largest sector in the European public-private partnership (PPP) market in terms of number of projects and value.7 Transport accounted for roughly €9.1 billion worth of transactions in 2023, up from €5.2 billion in 2022.8

Past performance is not indicative of future results

By country, France has a strong pipeline of more than 50 projects, with the environmental sector accounting for 45% followed by transport with 36%.9 The UK frequently uses PPPs, including for the development of electric vehicle charging networks and to help fund initiatives for heat, power plants, battery storage, and others.10

Past performance is not indicative of future results

Aiming to help close the infrastructure investment gap, European policymakers have implemented various funding vehicles and policies, such as NextGenerationEU (€750 billion), the Cohesion Policy (€378 billion), and the Connecting Europe Facility (€33.71 billion).11 In addition, policymakers have provisioned loans and other financing methods of financing via the EIB.

With this funding, policymakers are prioritising four key infrastructure areas: traditional infrastructure, infrastructure networks, clean energy infrastructure, and digital infrastructure.

Traditional Infrastructure for Economic Competitiveness

Traditional infrastructure encompasses a wide range of assets, including transportation networks, utilities, and social infrastructure.

Developing and improving traditional infrastructure can increase economic competitiveness by reducing logistics and transportation costs and increasing the speed of production and delivery for all industries. The EU allocated €392 billion for its Cohesion Policy,12 a significant part of which will be used to support the construction and maintenance of traditional infrastructure projects through the European Regional Development Fund (ERDF) and the Cohesion Fund. With a budget €33.71 billion for the 2021–27, the CEF will also support the development of high-performing, sustainable, and efficiently interconnected trans-European networks in the transport, energy, and digital services areas.

Vinci SA is an example of a traditional infrastructure company that can benefit from such funding. A French construction and concessions company, Vinci builds and operates transportation infrastructure such as roads, bridges, and airports. In 2023, more than 267 million passengers passed through its airport network, which includes more than 70 airports across 14 countries.13, 14 Vinci is also involved in the construction of infrastructure projects across Europe, such as the Fehmarn Belt fixed link, an immersed tunnel that is expected to almost halve the train journey between Copenhagen and Hamburg.15

Balfour Beatty primarily focuses on infrastructure investment, construction, and support services. Among its claims to fame is the company’s award-winning London Aquatics Centre, which it built for the 2012 Olympics.16 While Balfour Beatty is heavily involved in infrastructure construction throughout Europe, the UK accounted for more than half of the company’s £16.5 billion order book as of the end of fiscal year 2023.17 Recent projects include several rail stations on the recently completed Elizabeth Line in London.18

Buzzi SpA is a leading Italian cement and construction materials supplier that can benefit from the EU’s funding programs. Notably, Buzzi has invested in research and development to produce more environmentally friendly cement and concrete. By aligning with the EU’s sustainability goals, the company is a preferred supplier for infrastructure projects that prioritise environmental responsibility.

Infrastructure Networks to Facilitate Movement

Infrastructure networks encompass the interconnected systems that facilitate the movement of people, goods, and services across regions and borders.

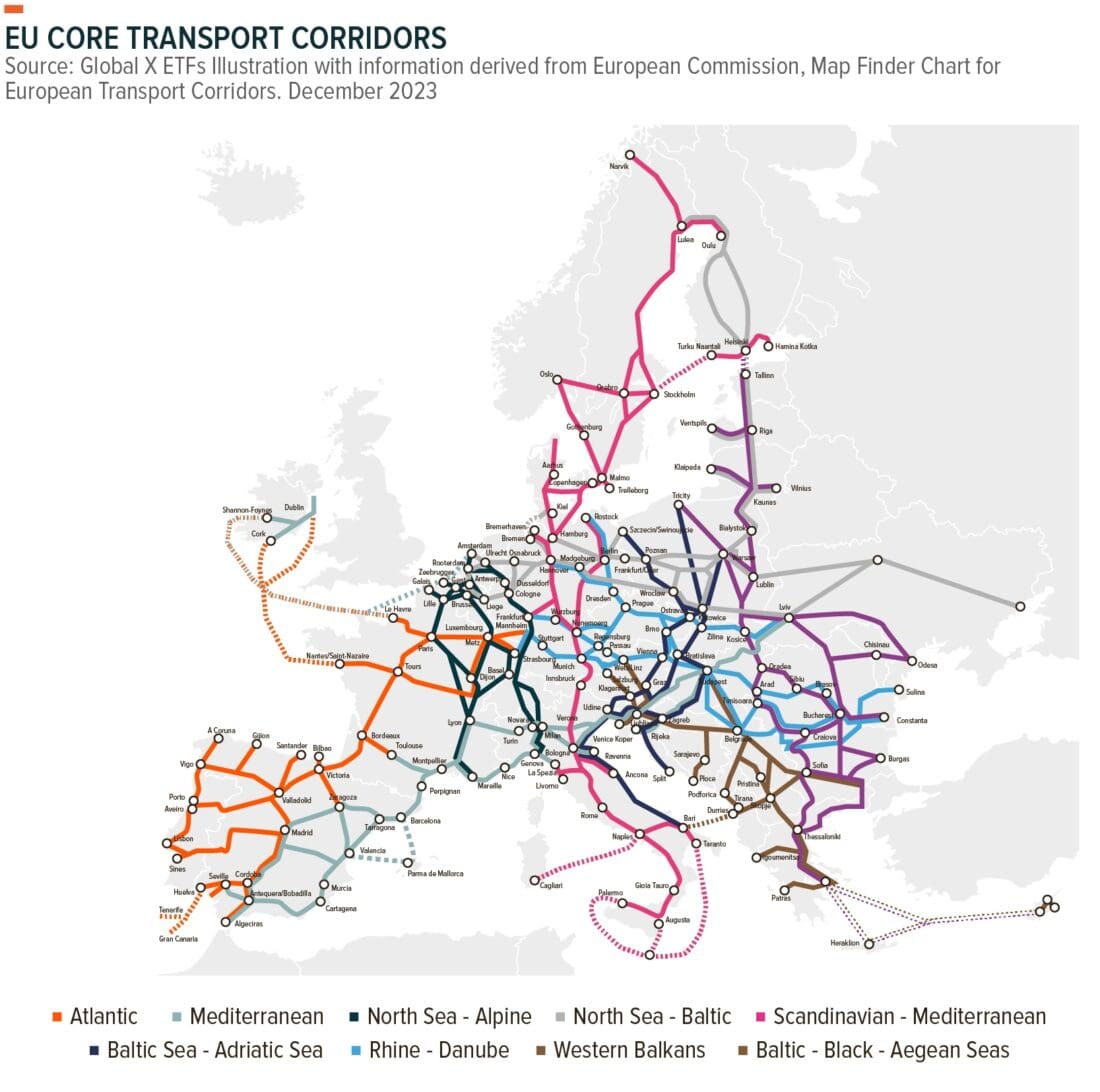

Transport currently accounts for approximately a quarter of EU greenhouse gas emissions, which the European Green Deal aims to reduce by 90% by 2050.19 To meet that goal, promoting sustainable transport though solutions including digitalisation and multimodal transport is a policy priority.20 The EU’s Trans-European Transport Network (TEN-T) policy aims to develop a comprehensive network of roads, railways, inland waterways, maritime shipping routes, ports, airports, and railroad terminals throughout the EU.21 The current focus is to develop the core network by 2030. This network includes links between major cities and nodes. The other focus is to develop the comprehensive network by connecting all regions of the EU to the core network by 2050.22 The key funding instrument for the TEN-T policy is the CEF, which will allocate €25.8 billion for sustainable and efficient transport systems from 2021–2027.23 The CEF will allocate 60% of its budget to infrastructure projects linked to sustainability.24

Companies involved in the development and operation of these infrastructure networks may be well-positioned to benefit. An example is Aena SME SA, which operates airports and heliports across Spain. In February 2024, the company signed a €140 million loan with the EIB to finance improvements in airport safety and operational resilience and innovation and IT projects.25 This loan was the third tranche of an €800 million EIB financing package approved in 2022. It is a prime example of a PPP between the EU (via the EIB) and a strong operator.

Clean Energy Infrastructure for Carbon Neutrality

Clean energy infrastructure includes renewable energy sources, such as wind and solar power, and energy storage and distribution systems.

The European Green Deal aims for a greenhouse gas emission reduction of at least 50% compared to 1990 levels by 2030, and to make Europe climate-neutral by 2050.26 One-third of the €1.8 trillion NextGenerationEU Recovery Plan and the EU’s seven-year budget will go towards financing this ambitious goal.27 BloombergNEF estimates that over $32 trillion will be required to deliver a net-zero economy in Europe by 2050.28

In 2023, recognising the scale of the challenge, the EIB increased the funding of the original REPowerEU package by 50% from €30 billion to €45 billion and broadened the scope of sectors eligible for financing.29 This funding is to be deployed by 2027 and is expected to mobilise an additional €150 billion in funding.30 Other measures include The Innovation Fund, which is backed by the monetisation of 530 million Emissions Trading Scheme (ETS) allowances.31 It supports low-carbon technologies and processes in energy-intensive industries, renewable energy, energy storage, and carbon capture, utilisation, and storage.

Among the companies poised to potentially benefit from the EU’s plans transition to a low-carbon economy and promote sustainable energy solutions is EDP Renováveis, a global leader in the renewable energy sector. The company’s renewables portfolio consists mostly of wind onshore, complemented by a growing solar business.32 In Q1 2024, the company generated 51% of its revenue in Europe.33

Digital Infrastructure for More Dynamic Connectivity

Digital infrastructure refers to the physical and virtual assets that enable the transmission and processing of data, including fibre-optic networks, data centres, and cloud computing infrastructure.

Better digital infrastructure leads to enhanced connectivity, enabling businesses to expand their reach to broader regions, including rural areas. Beyond the direct impacts on competitiveness, high-quality digital infrastructure typically attracts foreign direct investment, provides a conducive business environment, increases social mobility, and spurs innovation hubs through enhanced digital infrastructure, including high speed internet and reliable communication networks.

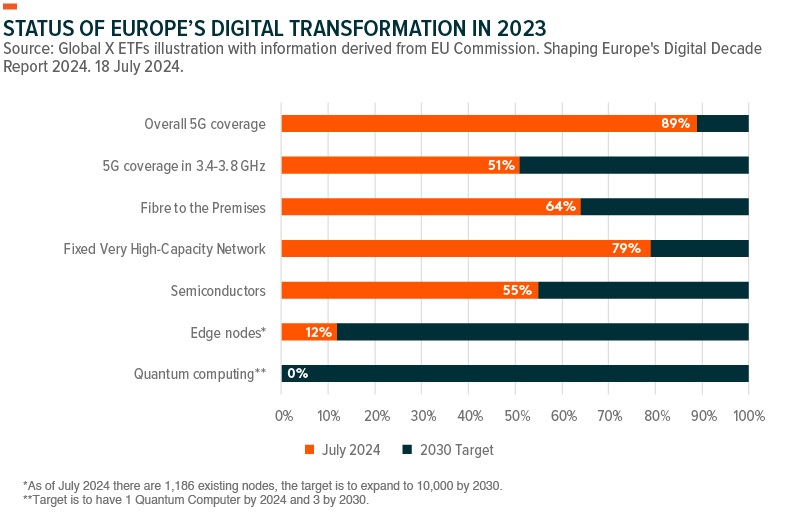

The EU’s Digital Decade Policy Programme 2030 set out targets for 2030 across four key areas: digital infrastructure, digital transformation of business, digital skills, and digital public services.34 The EU is expected to contribute €165 billion towards these targets, with 70% of this funding expected to come from the Recovery and Resilience Facility, a major part of NextGenerationEU.35 Other funding sources include the CEF, which has allocated €2.07 billion to the digital sector from 2021–2027. It aims to support the deployment of and access to secure and sustainable digital connectivity infrastructure across the EU.36 The 2023 “State of the Digital Decade” report showed that there is still progress to be made to achieve the 2030 targets.37

Past performance is not indicative of future results

Companies that can potentially benefit from the EU’s digital push include Thales SA, a French multinational that develops electrical systems and provides services for the aerospace, defence, transportation, and security markets. The company has expertise in cybersecurity, digital identity and management, connectivity, big data, and artificial intelligence.

How BRIJ Invests in European Infrastructure

BRIJ is designed to provide exposure to companies that can derive additional revenues from increased spending on publicly and privately funded infrastructure projects. BRIJ’s focus on European infrastructure companies generating over 40% of their revenues in Europe sets it apart from other infrastructure investment products, which tend to have more global revenue exposure.38 Implementing such a strategy could diversify risk/return profiles of more traditional portfolios that may be heavily weighted towards the United States, and the IT and Communication Services sectors.

Compared to the MSCI Europe Infrastructure Index, which is heavily weighted towards Utilities (59.8%), BRIJ is heavily weighted towards Industrials (72.8%). BRIJ has significantly higher weightings in the Construction & Engineering (37.8%), Airport Services (13.3%), and Aerospace & Defence (11.6%) sub-industries.39

BRIJ also has a higher concentration towards French (39.6%) and Spanish (33.2%) companies compared to the MSCI Europe Infrastructure Index, which has a greater weight in UK (22.13%) and German (17.13%) companies, which tend to have more global revenue exposure.40,41

Conclusion: Capturing Europe’s Public Infrastructure Investment

Robust and well-maintained infrastructure can be crucial for economic growth, productivity, and competitiveness because it facilitates trade, attracts investment, and enhances quality of life. Recent public policies and investments demonstrate the EU’s commitment to addressing the region’s infrastructure needs and positioning Europe as a leader in sustainable and resilient infrastructure development. For investors, it is possible that exposure to a basket of European companies across the region’s infrastructure value chain offers compelling growth potential. .

This document is not intended to be, or does not constitute, investment research

Footnotes

1 Access to European Union law, Communication From The Commission To The European Parliament, The European Council, The Council, The European Economic And Social Committee And The Committee Of The Regions – The European Green Deal. 11 December 2019.

2 EU Commission. EU invests record €7 billion in sustainable, safe and smart transport infrastructure. 17 July 2024.

3 Infrastructure Outlook, Global Infrastructure Outlook. Accessed July 2024.

4 Ibid.

5 Ibid.

6 European Investment Bank. Review of the European public-private partnership market in 2023. March 2024.

7 Ibid.

8 Ibid.

9 Ibid.

10 Ibid.

11 European Union, NextGenerationEU. Accessed July 2024.

12 European Commission, 2021-2027: Initial cohesion policy EU budget allocations. October 2022.

13 Vinci, Our airports. 2024.

14 Vinci, 2023 annual results. 7 February 2024.

15 Vinci, The Femern Tunnel – a groundbreaking tunnel between Germany and Denmark. 3 March 2021.

16 Balfour Beatty, London Aquatics Centre. 2024.

17 Balfour Beatty, Annual Report and Accounts 2023. 12 March 2024.

18 Balfour Beatty, Crossrail – Whitechapel and Liverpool Street Station Tunnels. 2024.

19 European Commission, Sustainable Transport. Accessed July 2024.

20 European Commission, A sustainable and resilient transport network bringing Europe closer together. 13 June 2024.

21 Access to European Union law, Regulation (EU) 2024/1679 of the European Parliament and of the Council of 13 June 2024 on Union guidelines for the development of the trans-European transport network, amending Regulations (EU) 2021/1153 and (EU) No 913/2010 and repealing Regulation (EU) No 1315/2013Text with EEA relevance. 28 June 2024.

22 Ibid.

23 Access to European Union Law, Union guidelines for the development of the trans-European transport network, amending Regulations (EU) 2021/1153. 13 June 2024

24 European Commission, Sustainable Transport. Accessed on 27 July 2024.

25 European Investment Bank. Spain: EIB and Aena sign €140 million loan to finance investments in safety and innovation projects at airports. 5 February 2024.

26 Access to European Union Law, Communication From The Commission To The European Parliament, The European Council, The Council, The European Economic And Social Committee And The Committee Of The Regions – The European Green Deal. 11 December 2019.

27 European Commission, The European Green Deal. 15 January 2020.

28 Bloomberg NEF, Huge Acceleration Required for Europe to Get on Track for Net Zero. 15 May 2023.

29 European Investment Bank, EIB to support Green Deal Industrial Plan with €45 billion in additional financing. 12 July 2023.

30 Ibid.

31 European Commission, What is the Innovation Fund?. Accessed on 24 July 2024.

32 EDP Renewables. Q1 2024 Results Presentation. 9 May 2024.

33 Ibid.

34 Access to European Union Law, Decision of the European Parliament and of the Council of 14 December 2022 establishing the Digital Decade Policy Programme 2023. 14 December 2022.

35 European Commission, 2030 Digital Decade Report. 27 September 2023.

36 Global X ETF data with information derived from Morningstar Direct. Scan of Public Equity Infrastructure Sector Category Funds. 5 August 2024.

37 Global X ETFs data with information derived from Bloomberg Terminal. GICS sector and sub-industry breakdown. 18 July 2024.

38 Access to European Union Law, Regulation (EU) 2024/1679 of the European Parliament and of the Council of 13 June 2024 on Union guidelines for the development of the trans-European transport network, amending Regulations (EU) 2021/1153 and (EU) No 913/2010 and repealing Regulation (EU) No 1315/2013Text with EEA relevance. 28 June 2024.

39 European Commission, 2030 Digital Decade Report. 27 September 2023.

40 MSCI, MSCI Europe Infrastructure Index – Index Factsheet. 28 June 2024.

41 Global X ETFs Data with information Derived from Bloomberg Terminal as of 26 April 2024.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Leave a Reply

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Global X ETFs Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or Global X ETFs Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Hmm is anyone else having problems with the images on this blog loading?

I’m trying to figure out if its a problem on my end or if it’s the blog.

Any feedback would be greatly appreciated.

Thank you for reaching out. We cannot replicate your issue.