Giuseppe Sette – Toggle AI’s Cofounder and President joins IBKR’s Jeff Praissman to discuss how to use options to improve your investment outcome.

Contact Information:

Summary

The following is a summary of a live audio recording and may contain errors in spelling or grammar. Although IBKR has edited for clarity no material changes have been made.

Jeff Praissman

Hi everyone. Welcome to IBKR podcast. I’m your host, Jeff Praissman. It’s my pleasure to welcome Giuseppe Sette, one of the Co-founders and President of Toggle AI. Giuseppe graduated with an MS in electrical engineering from La Sapienza University and an MBA from Wharton, as well as holding a patent in acoustic propulsion via ultrasound. Welcome Giuseppe, thank you for joining us.

Giuseppe Sette

Well, thank you for having me. It’s always a pleasure to be speaking with IBKR folks.

Jeff Praissman

Prior to Co-founding Toggle AI with Jan Szilagyi, who we’ve been fortunate enough to have in the studio a few times, both of you were Co-CEOs of Global Macro at Lombard ODA. And you also spent some time at Brevan Howard, Davidson Kempner and at Bain Italy. So today we’re going to discuss using options to improve investment outcome. So Giuseppe, let’s start with some of the benefits of trading options.

Giuseppe Sette

Absolutely. Options are a main staple for professional investors and they’re also very popular with retail traders. In my career I have traded options for like the good part of almost 2 decades and I find them useful. I find them stimulating, but you need to know what they’re for, what they do for you. Options are effectively, in the simplest terms, a way to outsource your risk management. Let’s start from the simplest basics. Imagine a classic call option on your favorite stock, Tesla, since that’s most likely to be someone’s favorite stock. As you guys know, Tesla options at one point represented almost half of all volumes of options in the US. You buy a call option on Tesla and what you’re saying is I don’t want to worry about the downside, can someone manage this for me? And the market is there for you, and they say sure we’ll do that, no problem, here’s the price. The key thing that options do for you is that they help you avoid some of the classic fallacies of investing. It’s very, very easy for both, if you want nonprofessional traders, but also for retail traders to fall into classic fallacies of risk management. The market is an emotional affair when you’re losing money, it’s a skill to keep your head straight and options in a sense allow you to do that with much more calm because you’ve paid your price for price for insurance. You know what you’re going to lose when the market is imploding. You’re thinking, OK, well, you know what? I almost got away scott free because I just paid my premium and that’s the most I can lose. And that puts you in a better spot than having both your Tesla share outright and seeing it tank, you know, 20% in a week, which Tesla can easily do, and by no means is this only applied to Tesla, but it’s a good example because it’s popular. So, getting back to where I started, the options are fantastic because they’re a way to go and offset your risk management tasks to someone else.

It works well if you’re a day trader because day traders can have well 2 main issues. One is the market can be extremely volatile intraday, leaving you sometimes shell shocked, especially on days when there is news flow. And two, sometimes you cannot be on the market continuously, but options, they’re always fantastic because they’re also fantastic for swing traders. You have your view, your directional hypothesis or your volatility hypothesis, you set it down with your option structure and then you just wait and let your swing play one way or another. Obviously, like the good aspects of options, don’t stop here. The other fantastic thing, the options let you do is compose them. You can really tailor your view of the market and your view of risk in such a way as to be precisely, almost surgically, where you want to be. So this is all that’s fantastic about options, but we need to make a disclaimer. It’s not even like, you know, the other side of the coin. It’s just like, you know, we need to dispel a myth.

There’s no alpha per say in options and for a good reason. So what do we in the industry, what do we mean when we say alpha? We mean intrinsic returns that you can recurrently extract from the market. Alpha starts from like some financial mathematics that I’m not going to get into, but effectively it tells you your X return on the market, meaning everybody can get the return on the market. Just buy the market. But if you can do better than the market in financial mathematics, it’s called alpha and nowadays you’ll hear it used as the return you can generate without being bound to the market and to other risk factors. So, you’ll hear me use that term through this to this conversation, but in this specific case, what I meant when I said that there is no alpha in options, I meant that there is no way to consistently and simply do something with options, let’s say, buy a cost spread, buy a put spread — and we’ll get into what these terms mean — and just make money. And the reason for this lack of alpha, which means of stable exploitable returns, is that these options are priced by extremely bright and very motivated Quantsin all the top banks and all the market makers. They know exactly what they’re doing. They’ve been back testing these options for the good part of the last 40 years when options became popular. And I can tell you, anybody here on this podcast, listening to this podcast, sorry, can go online, go on the site of Cboe, buy the option time series of any stock that you like. Try to back test them in whichever way possible. You will find that consistently no matter what the level of volatility, what your strike is, options are fairly priced. You need to have a view to make money with options. Having said that they are fantastic.

Jeff Praissman

Now of course with all investing there’s, you know, risk and rewards and you definitely cover some of the rewards and it seems mostly speaking about being long premium in those options as well, where the risk is only your premium that you paid for the options. Obviously, a whole other risk if you’re selling premium where if your view is wrong, there could be very high losses or somewhat unlimited losses if you sell a call for example. But you know besides for — I don’t know if fairly priced would be a downside, but what are some of the other risks or downsides to the trading options?

Giuseppe Sette

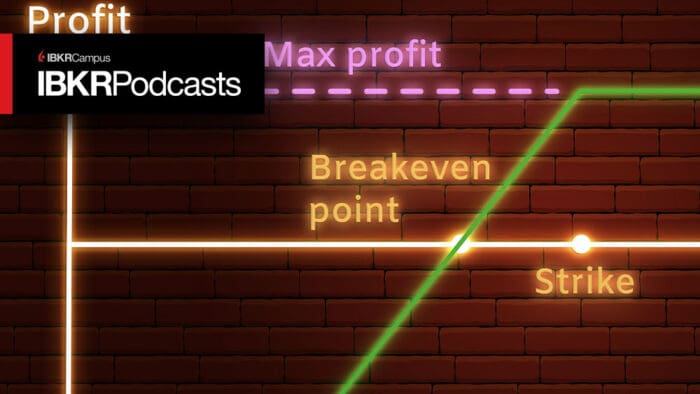

It’s a good question. Let me start from like from where you correctly prompted me to say, elaborate. So far, we’ve talked about the fact that if you buy options, you know your downside, easy peasy. Call costs you $3, that’s $300.00 you can pay at the most. I’m saying 300 because as most on the podcast will know, usually there is a multiplier around option, usually $100.00. So if you see a screen price of three, it means that you have to shell out 300 to buy the option. In reality, you can do some very fancy mathematics, or if you want geometric drawings with options, you can buy a call at the money and at the money means that you can make money from where the stock is today and I say stock, it could be oil, it could be S&P 500 Index, whatever. Options are available on almost anything. And then you could sell option two calls in the same position out of the money. Now let me reiterate what I’m saying, you’re taking a position that makes you money right away. From here, if the stock goes up you profit, aside from the premium you paid, but then you say, oh my God, this premium is so expensive I want a cheapen it up. A still very safe thing you could do is to say, well, you know what? I don’t need to make money beyond 5% profit so you can sell the rest of the profit. From here to 5% you make money, beyond 5% you don’t make money anymore. All of a sudden you have deployed much less risk, much less premium and your risk return is very clear to you.

If it’s at the money, you’re probably like paying one and getting a risk return or getting a profit of maximum less than one by the way calls are structured. You can do more to your point, you can start to sudden you find yourself back in the position of having both long or so short a security and why is that important to understand? It’s important to understand because the risks in those cases end up becoming not necessarily infinite by extremely uncontrolled that brings you back to where you started. If you want to take that kind of risk, you can very simply take the stock out right and watch it because you don’t have a complete service risk management anymore. It’s an interesting way to play. I’ll talk about it later about some of the option structures that people like to play and that sometimes blow up in the face even of a professional investor. But before we go there, there’s a second risk that we need to talk about, delivery. An option, as they say, read the fine print. An option is a contract, a contract to deliver to you a certain whatever at a certain price. We call it underlying because it’s a contract and underlying the contract is a security. If I have a Tesla option to buy Tesla at, let’s say $1000, it means on expiry I have the right to but Tesla at $1000. The counterparty has the obligation if I exercise that right to actually sell it to me at that price.

Now, what happens to some traders and this has been sadly in the news in the boom days of GME in 2020 when there was like this great inflow of young traders in the market that still need some guidance and some if you want like education about markets. This has been the source of some serious losses and in one case even suicide, because of this. One trader in particular traded the call spread, the call spread is what we discussed just a moment ago. It’s a structure made of one long call and one short out of the money call. Imagine in the case I was making; you say I’m going to buy the upside of Tesla from zero to 5% top and then I don’t need the rest. When you do that, you are convinced that your maximum loss is the price of the call spread. You are right and you are wrong. You are right because up to the moment of expiry there’s no more that you can lose. If Tesla collapses to 0, whatever you paid for the call spread is what you paid. However, the day when or when the spread settles, there is a small but non zero risk that Tesla expires squarely in the middle of that call spread between the 0 and 5% profit, I’d say 2 1/2% to make it simple. Then something technical and somewhat nasty happens, you get delivered whatever amount of stocks was in your bet, and this can get tricky because a 5% call spread, especially in Tesla, it’s very cheap. You could have spent like, I don’t know, a couple of brands to make your bet. You don’t realize that that’s probably like a $300,000 position in notional that gets delivered to you at expiry. Now imagine this, at that moment you have a flip of a coin because you get delivered, it’s Friday, market’s closed see you Monday. Monday, Tesla could open up 3% or down 3% and you have a gigantic position. What’s the lesson of this? The lesson is to always close your options before expiry, because you, especially in stocks space, you should never take delivery unless you know exactly what you’re doing. So, I think that like these two examples we’ve talked about boil down to not understanding your risk. Options are fantastic to contain risk, but to lose, they’re double edged in this sense because if you don’t understand how they’re containing risk, you might be on the wrong side of the trade.

Jeff Praissman

Right, and a lot of people may not understand, you know, they should understand the multiplier effect with the standard 100 shares of stock but if they don’t, you know that situation can happen. And you know you have a ton of investment experience besides fear, — obviously your philosophy on handling option spreads — could you also share with our listener your philosophy on investing? Like specifically, you know, we discussed alpha a little bit earlier, just kind of the definition but also like the structuring and then reloading. Basically, there to kind of fight another day for lack of a better word.

Giuseppe Sette

No, it’s an excellent way to say it, I think that these are the three sides of the same triangle. So, we’re going to talk about alpha, which is how to make money in a stable fashion, whatever the market does. Then we going to talk about structuring, which is being the core of what we discussed and then reloading. Alpha is effectively the product of your investing style, and there are many investing styles. Most people, if they’re listening to a podcast about options, might be familiar maybe with Warren Buffett and his value approach. I mean, I don’t think Warren Buffett has been value for like a few decades. It’s been more of a growth at the right price kind of guy but in any case, he has his price sensitive. There are people that like me and the like, the grandy’s of the space that we worked in, like George Soros to George Jones, of course Sammy Druckenmiller. With an investor in Toggle, we trade the global macro, which means that we take views on the large benchmark indexes and gauge where they might go based on where the economy is going.

There are probably the largest core of investors, which is the equity fundamental investors. They look at securities, they make a call on whether the … let me say the earnings for simplicity, are going to go up or down and whether the stock is going to actually reappreciate thanks to that move. Up or down, by the way, like you can be a short seller and be fundamental. Then there are like the few of the technical investors of yesterday, which have all been effectively subsumed in today’s world for the professional side, into the quants. And quant people, are like people in the Renaissance technologies, the hedge funds, but also in the market makers. They are the people that look at market for recurrences. I’m going to say something silly, but you might be discovering that like you know, every 3rd day of the month, if the moon is full, something happens to the market. I’m being facetious, but only have to a point. Believe me, like quant will try and test anything and if they find the regularity, they don’t need a story behind it because they their statistics. They are a power force in the market. At these points between market makers and quants, they make up the large and vast majority of trades in the market and their alpha is based on their statistics. So, we’re circling around the fact that to make money to use options or not use options you need a view. Some people might be getting their views from articles in the press, some people might be getting their views because they think that some products are just too good for their companies to not do great in the next 10 years. Alpha is a concept that’s based on your views, your style and also your investing horizon. There can be alpha trading on a swing basis in the next 10 days or next two months. There can be alpha trading, but it would be called investing for the next 10 years.

If you had seen Tesla and what it could do 10 years ago, you would have been a fantastic investor. Some people have done that, and they’ve been rewarded. Now if you have a view you need to be able to see it through whatever is your horizon, and so we’re going to move to structuring. Structuring is a way to say that I need to package my risk management policy around my trade. So let’s start simple , let’s abandon Tesla for a second just to move like into global macro space. I believe that treasuries are a fantastic buy because the Fed is going to give us a one and done kind of rate hike. So, the Fed cycle is probably done for this cycle — excuse me — the hiking cycle is probably done this time. And so I want to buy treasuries, good for me. Buying treasuries, even though they’re a safe asset, is still something that carries risk, especially if you take the long maturities, 10 years, 20 years. So, you need to be ready and aware that, like, even though you’re right in your horizon in one year time maybe, you might be wrong in the next month, and nobody has infinite risk tolerance. You might be putting this trade on and you’re saying I don’t want to lose more than 2% of my portfolio, 10% of my portfolio, whatever it is, nobody has infinite risk budget. So structuring means how do you want to deal with the fact that you might be wrong in the short term, even though you’re right in the long term or that you might be wrong period. All professional investors have had like not one, many trades where they just got it wrong. You need to cut at some point. How are you going to cut? I mean there’s a million ways to like go around it, but effectively either you decide to cut your position gradually or all of a sudden, or you find some options that do that for you and you pay the price upfront.

And this brings us to the last point which is reloading. Reloading is simply the fact that the best investor is the investor that doesn’t lose money. I’m making obviously a theoretical statement like, you know, there’s no investor that never loses money but conceptually, if you never lost, if you knew a way to never lose money, you could invest on coin flips or securities you know nothing about because your risk management is so good. What is the goal of like proper risk budgeting and reloading for an investor with a view? You might be wrong for the next month, but very right in the next three years. You don’t want to be completely out of the trade, out of the market, cut off in your portfolio if you’re wrong today. In many, many professional environments, especially in the very popular multi-strategy funds that are extremely successful these days. I’m going to say Millennium to mention one out of many. Risk managers are very much on the shoulder of portfolio managers, and they impose very tight risk constraints. Pretty much each of these shops works with the strike two and then out approach. You have given a massive loss in your portfolio, let’s call it 10%. So, you’re down 3 ½ percent like yellow alert. You’re down 6 1/2%, orange alert. You’re down 10%, that’s the door. It’s very, very, very tight and so you need to be aware that like your views are probably not unfounded, you’ve done well research and whatever else.

Now if you don’t want to get a red card, the red alert and booted out of the door, you need to be aware that you can put all your capital risk today. Where is the lesson for nonprofessional trader there? We’re all facing the same issue. We all want to trade the market because we find it intriguing, fun and we like the opportunity to profit from our views. But oftentimes risk allocation is something that the retail space focuses less on, and the press is full of examples. Just go on, let me say that the classic place for seeing the worst losses in the industry … go on Reddit and Wall Street Bets and you’ll see people flaunting the amount of losses that they’ve managed to achieve and that’s a classic case of unloading on the wrong trade in the wrong amount.

So you see the triangle, you need to have a view, need to structure in such a way that you can stay in the trade for the long. And I’ll close it with what I mentioned about being wrong. In some cases, your ability to reload to structure needs to take into account that you have a limit. You will find the moment where you want to just get out, please.

Jeff Praissman

Yeah, I was going to say so it really sounds like whether or not you’re managing, you know, $100 million fund or a $5000 personal account, it really makes sense for every investor to kind of know the max loss that they’re willing to take on their view. First of all, come in with a view, an educated view of where they think a market or markets are particularly going. Come up with basically a game plan of what instruments can help them achieve that, and then also know their exit strategy as far as when, if things aren’t going as planned, where they should get out so that they can go on to continue investing and continue trading and continue to basically live another day for lack of a better word.

Giuseppe Sette

Another day, definitely.

Jeff Praissman

Again, just to really say like you’ve been doing this a long time, immense industry experience. Could you share with our listeners an example from your time in industry? One of the better option trades you that you had or were part of and sort of just a little bit of a context around it as well so they can kind of just briefly — just a little bit context around the trade as well, just so they can see kind of the full story behind it.

Giuseppe Sette

Yeah, absolutely. Absolutely. I think that one of the best traits that we’ve had within the scope of global macro trading mandates was definitely on treasuries and it’s a timely thing to mention because we’ve been through a moment of massive sell off. We space basically spent two years seeing Treasury selling off hard. The press is full of like stories about this. The reality is that this that we’ve seen in the last two years, this hiking cycle, had a false start at this point four or five years ago. In 2016, we started to talk about, OK, well this is mid cycle. The Fed needs to start hiking and we need to start to like you know, looking at treasuries with a bit of care. There was a small hiking cycle or a small sell off in 10 year treasuries that effectively took them over from mid-2016 to almost 2019. And this … we knew that something would be coming. The Fed was making the right noises, the economy was making the right noises. Like, I mean, you can see that sometimes things are working well, but short in treasuries is a beast because treasuries have so much carry against you. For the long term, you want to be long treasuries. They’re a beautiful part of your portfolio. They’re the pillar of disparity and they should be in your long-term allocation plans.

But for a trader with a mandate to study the Fed and understand when they start to sell off, they pose a challenge that’s really technical to show. So, what we did that worked really well was to use the skew that you get in option space for treasuries and here I’m going to get technical so let me try to lay it down as simple as possible. The price of options changes depending on how far from the current price of the security they are. In treasuries, the cheapest option that you can buy where the treasury bond or future specifics is right now. As you move away from like, if you want to buy treasury options of like, you know, they give you profit after like a 3% move up or down, doesn’t matter but mostly on the upside. Then they become reasonably more expensive because there are like fat tails, especially for treasuries going up. Now, the fascinating aspect of this is that you could do the following: treasuries naturally go up when the market goes down, so the fat tail is on the upside of treasuries. That means that for treasuries to fall down, it’s considered the case that’s somewhat cheaper. The market doesn’t really believe it. You know why the market doesn’t believe it? Because for 40 years they’ve been going up. That offered us effectively a value opportunity at the time. The market was still pricing and to a degree even now after this big sell-off is still pricing the downside of treasuries with much less weight than the upside, because the moment where everybody gets scared by the market, when the equities fall, everybody buys treasuries. Their fat tail is on the upside. That means that we could do some really smart structuring, to give you an example, we could buy three put options for treasuries to fall 3% by selling just one put option for treasuries to raise 3%. They gave us an immense staying power and that was important because we didn’t know when treasuries could move. Eventually they moved. They made the big move between 16 and 17. It was a very sharp move, which is great for these options. It went well past our expectations of move and our leverage was fantastic. Yeah, sure we had some downside, again, you need to understand there is always downside. But we were like managing that downside there on a day in – day out basis. But a risk return was three times the profit if treasuries sold off versus one time the loss. And if treasuries didn’t move much, they just had carry, we had zero impact on our positions. It was a very smart and articulated trade.

Now, this is obviously something that was requiring a team of managers to look at every day and you require a lot of organization to study, but there is a lesson also for an individual trader who probably like you know has a job in whatever profession he or she has. And the lesson is the following: if you like options and you’re engaging them and you spend your time before placing your trade to study, the vault surface, as we call it, which is like just the matrix that you see in any car when you load up your option chain, is what Trader Workstation calls it. You will find that there are opportunities and if you leverage these opportunities, they will make your life easier.

Jeff Praissman

You know, kind of the touch on what we spoke about with reloading, I got to ask you about a trade that maybe didn’t go as expected and kind of on that theme of reloading as well.

Giuseppe Sette

There is a structure, that is a bad structure for any manager, like for traders and whatever else. It’s a nasty thing, let me try to describe it graphically. It’s called the one by two. You buy one call or buy one put. It doesn’t matter, like you can use it on the upside or downside. You buy one call at the money, so you basically imagine a triangle. You start to make money up to a point. Then you sell 2 calls or sell to puts if you’re on the downside and therefore like your profit is a triangle. But when the triangle is finished, let’s say that you make money between 0 and 10%, when the triangle touches the zero-profit axis, that’s where your losses start. So if the market goes up, let’s say 9%, you’ve done well. If the market goes up 12%, you start to lose money because your profit, in the one by two is only between 0 and let’s say 10%. Why is it a tempting strategy as it doesn’t cost you anything if you’re wrong? You buy one option at the money; you sell two options out of the money. Your net outlay of insurance is 0, and that’s because you decided to take a lot of losses if the market goes too much in your direction. If you are too correct. Now for everybody who’s listening and is curious about what I’m talking about, just Google up the payout profile of a one by two, you will see what I mean. You don’t lose money if you’re wrong, but you’re losing money if you’re very right. And that is the most frustrating thing for a fund manager. Sure, it’s fantastic to have a one by two when you’re wrong, you say like ha-ha-ha, I survived and I’m unscathed. It’s exactly what I was planning to do. Great. Well done. The problem is that then if you’re right, then you start to become very right. You’re thinking, what am I doing? I should have been making profit because my views were correct and instead, I’m actually like nursing losses. So, the temptation of one by two is everybody feels it. The zero fundingof premium is something that’s enticing for anybody. I honestly have never seen it work. In the Treasury case that I mentioned before, we also had one by twos and those did not work. We had to manage them literally like hour by hour to make sure that the risk was not coming against us. I think that in some cases we even made money, so we are not too wrong, but the stress of managing this structure makes it completely not worth the risk.

Jeff Praissman

So, if it goes past that second strike, then your losses start magnifying because your long option is only covered by the one short but you have that extra short option that’s going to start generating losses at an exponential rate for you as you get more and more right, as you said on the stock price but more and more wrong on the strategy you chose.

Giuseppe Sette

Are more and more wrong on the other side, exactly right.

Jeff Praissman

I want to take a step away from the professionals for a second and just kind of concentrate more on the retail traders and investors and you touched on, you know, a little bit prior in a kind of an introductory question about the role options could play. But in your opinion for retail investors that don’t have access to entire teams of quants and PHD’s and super smart people that are spending their whole day analyzing markets, what role should options play if any for retail?

Giuseppe Sette

So, I think that like it depends on your trading area and your horizon. And let’s split any individual investor and by the way, like, we all are individual investors. Aside from our profession we all have a PE portfolio that we run. For the part of your PE portfolio that is meant to be there for the long run, I don’t think you should be engaging with options that much and that includes if you want like classic strategy like color writing and whatever else. That’s a tactical kind of in allocation and in our long-term portfolios, we are not that active. We are risk premium takers. Why does your pension make money? Because for 30 years you’re being a receiver of risk premium. Risk premium is just a fancy word to say that you’re holding risk and can be compensated for it. And the interest of your treasuries is risk premium, the need and of your stocks and the appreciation of your stocks is risk premium. So, if you’re thinking about your portfolio splitting in two, the long-term part, just let it be. It’s like a tree. It’s going to grow and when the day comes, it will make you happy. But obviously, this is IBKR and if anybody who’s here is probably like as passionate as we are about the short-term side of investing. Let’s call it trading in a positive way, even a one-year horizon can be a trading horizon. In that sense, I think that options are almost — I don’t want to say mandatory because some people like are very comfortable with trading what we call delta in the industry and what I mean is simply outright positions. Medium futures or stocks or whatever currencies, everybody has their own niche in the market. But I think that, especially for people that are making their first steps in the market and they don’t feel too comfortable about the risk that they’re taking and they might be panicking, options are a very neat way to take their first steps which, by the way, explains their popularity. If you notice the inflow of traders that we’ve seen in the market in the last, let’s call it four years, from 19 onwards. Options have been immensely popular and I’m glad that people are using them as long as they’re careful about some of their tastes. They become an easy way to take your risk.

See how you like the markets, find your niche, find your style. Make no mistake, they will not save you money if you’re wrong but they will let you play another day and they will do it in a way that doesn’t break your bank. Let’s not forget another case in which something very, very complex happened to people not using options, and IBKR knows what I’m talking about because some of this was actually taking place on the platform. You guys may remember that at one point a few years back that the future on oil went to zero for technical reasons. At that moment, a lot of traders that didn’t really understand technicalities of that future started to buy the future in spades, because if the future is trading for 4 cents, I might buy, I don’t know, whatever, like $1000 and have an immense exposure. That future went to -40 before delivery and that created some considerable losses for those holders of risk. Why is that? Well, because that’s uncapped risk, especially in future space. The reason why a future can go negative was very technical in that moment. We don’t need to go and rehash the story but the fact is that someone put down, let’s say, $1000, thinking that that was the most they could lose and discovered that that was not true. Options ensure you for that and therefore it’s a good premium to pay if you’re newbie. To make sure that you can trade today and trade again tomorrow.

Jeff Praissman

Yeah, I know. Back to the reloading theme.

Giuseppe Sette

Exactly, right. It’s all there, it’s all there.

Jeff Praissman

With everything, technology has just improved so much over — I mean, you know again exponentially. I mean Toggle AI is a perfect example of how technology can help investors and traders just sort through information, makes tools more accessible. Stuff that was not accessible to the everyday retail investor/ trader five years ago, is now almost every day included with platforms. The tools available for option trading, how would you say they’ve evolved or changed since you first got into the industry? You know, what are some of the main functions of the tools that people may use? I mean, obviously the Trader Workstation has a plethora of tools included, such as like Probability Lab, the right rollover tool and so on. But just like in a general sense, like what have you seen that sort of really come into play over your investing career?

Giuseppe Sette

I mean look, on any desk that trades options, you have option prices and option structures. They are not what your pay profile looks like and for those who are listening who know about like the technicalities of options, your Greeks. The Greeks are just numbers associated with options that tell us — the DNA of an option is called the Greeks. How they’re going to react to the market and to other changes in the market scenario.

Some of these tools have in a virtuous way, started to trickle into what is available in the space for traders. And I’d say like you know, Trader Workstation, is certainly like a comprehensive software. And therefore, like, you know, almost professionally in its capabilities, it does an excellent job letting you compose and study options. As someone who uses it almost every day, I find that the capabilities that TWS offers are almost on par with like professional software and especially things that let you see the payout of the option, the probability profile as you mentioned are very, very important. I invite anybody who trades options on IBKR, before they trade, to go and look at that specific sub window called the payout profile. You will be surprised at the numbers you will see there. Sometimes we trade these options and we don’t think about what they’re doing in the tail ends of the spectrum on the upside and downside and all of a sudden you see that like your gains or losses are magnified and what you thought was like, you know, a $3000 trade maybe as a far tale of downside of $60,000.

So one advice if I was if I were to give only one advice is use the tools that, in specific, IBKR gives you or any other broker just to be like balanced and plot out your payout profile. Look at the probabilities you will get surprises sometimes, but beyond that you probably want to benefit from tools that can help you understand the market probabilities in a skewed way. Let me explain what I mean, it’s again the topic of alpha. In a skewed way, meaning option prices will always tell your balanced view of probabilities. We just like take the current shape of the volatility curve and tell you well based on the market you stand to have like 52% on that side, 48% of the downside. Tools like Toggle take it one step further and say yes, but studying everything else around this stock or this commodity or whatever, looking at the fundamentals of this stock, the price performance of this stock, what the economy has done, we think that there is a skew and that maybe like the most reasonable scenario is a 5 to 10% depreciation. Tools like that allow you to step up your game. Why? Well, because options are fantastic to tailor your investing. If you were convinced that this specific stuff you like has a 25% upside probability, you have a fantastic chance to put down a very reasonably small amount of money and put out a trade that gives you like 4 to 10 times the profit. Because you’re saying you know what, I believe that the announcement that’s coming with the next earning release or like what Toggle has told me about the trend of the market or what I read about it in the Wall Street Journal makes me convinced of the upside. You can structure in such a way as to make the most out of.

So, options really shine if you have a view and the view is compelling because then the risk return will become fantastic. You can put down a grand and get back like 10 grand or whatever is your natural investment space. So, I think that what I like now is the 2 full set of tools. You need the technical tools like TWS to price your options and look at what they display, what they look like, and you need the alpha resources to build the view for yourself. I say resources and not just tools, applications like Toggle, they’re tools that let you test specific scenarios and build major confidence. But even just reading the earnings report of a company is going to be part of your process to build the view on that company. Once again, we’re talking companies, but I want to spread this to all the investors that are listening. They might like, I don’t know, natural gas trades or the euro dollar trades the XY. Again, you mentioned treasuries. Whatever you trade, it’s always the same conviction and structuring.

Jeff Praissman

I mean, just after this, this has been a great discussion. Thank you so much for coming by the IBKR Podcast. For more from Giuseppe and Toggle, please go to our website under Education to view previous webinars and podcasts as well keep an eye out for any upcoming live events. I also want to remind everyone that you can find all our podcasts on our website under Education, scroll down to IBKR Podcasts, or on Spotify, Apple Music, Amazon Music, Podbean, Google Podcasts, and Audible. Thank you for listening until next time, I’m Jeff Praissman with Interactive Brokers.

Giuseppe Sette

Thank you very much guys.

Disclosure: Toggle AI

IB Global Investments LLC, a subsidiary of Interactive Broker Group Inc., the parent company of Interactive Brokers LLC, is a minority owner of Toggle AI.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Toggle AI and is being posted with its permission. The views expressed in this material are solely those of the author and/or Toggle AI and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD). Multiple leg strategies, including spreads, will incur multiple transaction costs.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account