Originally Posted 09 September 2025 – Quick View: Political upheaval and budgetary uncertainty leaves France at a crossroads

Author: Robert Schramm-Fuchs

Following French Prime Minister François Bayrou’s loss of a confidence vote, Robert-Schramm Fuchs explores the implications for investors and explains why he remains positive on Europe, with France’s neighbour Germany offering a compelling macroeconomic narrative.

Key takeaways:

- France’s political instability and budgetary uncertainty could influence sovereign credit spreads and equity market performance.

- Investors are likely to see increased volatility in French assets, with Germany presenting a more stable and growth-oriented alternative.

- The pro-cyclical and bullish stance on European equities remains intact, but with a tilt towards German markets.

As anticipated, French Prime Minister François Bayrou lost a confidence vote in parliament, with 65% of the lower house voting against him. President Macron is expected to nominate a new Prime Minister in the coming days, likely from the Socialist Party within the governing grand coalition. However, this move may not sit well with other coalition members, especially with municipal elections looming in March 2026.

An alternative path could involve a technocratic caretaker government to pass the 2026 budget by decree. If no candidate garners majority support, parliament may be dissolved, triggering early elections. Until then, Bayrou is expected to remain in office as caretaker prime minister. Regardless of the outcome, the 2026 budget is likely to fall short of Bayrou’s savings targets – which were modest in the context of France’s broader deficit challenges.

Social unrest and sovereign ratings: Risks on the horizon

Adding to the uncertainty, protest movements organised via social media are set to begin later this week. These demonstrations could rival the scale of the ‘gilets jaunes’ (yellow vests) movement of 2018 – 2019. Meanwhile, Fitch is scheduled to release its update on France’s sovereign credit rating this weekend, with Moody’s and S&P updates expected in October and November. Fitch currently rates France at AA- with a negative outlook.

Without a societal commitment to fiscal restraint and clearer political direction, France’s sovereign credit spread relative to Germany is unlikely to narrow meaningfully. Depending on how events unfold, this could happen gradually or abruptly.

Market scenarios: Gradual recovery or sharp decline?

Two distinct scenarios could shape investor sentiment on France:

Scenario A: Gradual spread widening

In this more probable scenario, European equity markets may absorb the political noise. France-listed stocks could even rebound in the short term, having been weighed down by recent uncertainty. Macron, centrist parties, and the European Union (EU) have little incentive to escalate tensions. The European Commission is likely to approve a less ambitious French budget under its Excessive Deficit Procedure, provided there is progress on deficit reduction.

Scenario B: Rapid spread widening

Should political instability escalate, French equities may continue to underperform. The CAC40 Index recently hit multi-decade lows relative to Germany’s DAX and has since moved sideways. However, European equity markets have become adept at distinguishing between sectors and companies most exposed to sovereign risk.

Germany’s macro strength: A beacon amid uncertainty

In contrast to France, Germany offers one of Europe’s most compelling macro narratives. The country is deploying €500 billion in fiscal spending across infrastructure and defence, while the private sector is investing €631 billion through the “Made for Germany” initiative. A cohesive governing coalition is also pursuing modest reforms in welfare and taxation aimed at reviving growth and boosting sustainability and competitiveness.

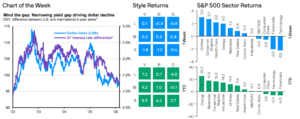

Globally, central banks are cutting interest rates, while steeper yield curves signal economic acceleration. These dynamics favour Germany’s export-driven economy and position Europe for underappreciated growth in 2026–2027.

Positioning for opportunity: A bullish stance on Europe

Investor positioning in Europe has become less crowded following a brief surge in early 2025. Structural reforms at the EU level and improving macro conditions support a positive outlook for European equities. We continue to hold a positive outlook for Europe and remain pro-cyclical and bullish, reflecting confidence in the region’s medium-term growth trajectory.

Disclosure: Janus Henderson

The opinions and views expressed are as of the date published and are subject to change without notice. They are for information purposes only and should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. No forecasts can be guaranteed. Opinions and examples are meant as an illustration of broader themes and are not an indication of trading intent. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. Janus Henderson Group plc through its subsidiaries may manage investment products with a financial interest in securities mentioned herein and any comments should not be construed as a reflection on the past or future profitability. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Janus Henderson and is being posted with its permission. The views expressed in this material are solely those of the author and/or Janus Henderson and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account