Equity indices are recovering from morning selling pressure as a stronger-than-anticipated flash PMI and existing home sales data countered a modest uptick in jobless claims. S&P Global’s 9:45 am figures signaled the fastest pace of economic growth in eight months as the services and manufacturing sectors expanded robustly, coinciding with a good week for retail earnings, which generally depicted an improving consumer rebounding after a weak first half of the year. But while the stateside calendar and profit results signal a rosy road ahead, rates are rising on the back of firmer activity projections and heavier inflation expectations. However, the potential for significant market swings is reserved for tomorrow, when Fed Chair Powell approaches the podium for his last Jackson Hole speech. Wall Street is awaiting a reduction from the central bank next month with an elevated degree of certainty in light of softening labor conditions and an emphasis from the Chief on price pressures and tariffs, rather than hiring and unemployment, can disappoint investors during this weak seasonal period. Meanwhile, an acknowledgement from Powell of the restrictive policy stance and the need to resume the FOMC’s walk down the stairs can bolster animal spirits, sending stocks north and yields south in bull steepening fashion, led by the short end. In trading action, the greenback is gaining as Treasuries descend, volatility protection instruments are catching bids, and the commodity complex is largely bullish minus lumber and gold.

Economy Expands at Fastest Pace of the Year

This morning’s flash Purchasing Managers’ Index (PMI) data from S&P Global depicted the fastest pace of economic expansion all year. The 55.4 and 53.3 August scores for services and manufacturing flew past expectations of 54.2 and 49.5 and were both well above the growth-contraction threshold of 50. The results compare to July’s 55.7 and 49.8. Strong ordering and hiring momentum in the two segments drove a meaningful increase in backlogs, while tariff pressures and heavy transaction volumes did drive inflationary forces north from both supply-push and demand-pull perspectives. Production activity and business sentiment also reported advancement, bolstering the case for reaccelerating conditions ahead.

Home Price Growth Nears Zero

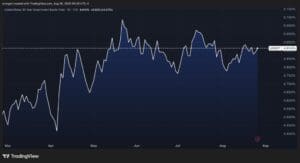

Existing home sales recovered slightly last month as price growth nearly turned negative. The pace of closings expanded 2% month over month (m/m) to 4.01 million seasonally adjusted annualized units, better than the 3.92 million median estimate and June’s 3.93 million. But values only grew 0.2% year over year (y/y), pointing to reduced pricing power amongst prospective sellers as affordability remains incredibly stretched. Potential buyers remain hampered by elevated costs and heavy mortgage rates, even as inventories grew to 1.55 million units, the tallest level in over 5 years, since May 2020. Indeed, supply is up 0.6% m/m and 15.7% y/y. In July, most regions saw transactions climb, with the Northeast, South and West reporting gains of 8.7%, 2.2% and 1.4%, countering the 1.1% decline in the Midwest.

Unemployment Claims Climb Modestly

Unemployment claims climbed in the past two weeks and surpassed estimates but remained in the relative safe zone from a labor market health perspective. Initial filings rose to 235,000 during the week ended August 16, above the previous period’s 224,000 and the expected 225,000. Continuing applications increased to 1.972 million throughout the seven days culminating on August 9, exceeding the projected 1.960 million and the 1.942 million from the prior interval. Four-week moving average trends escalated on both fronts, from 221,750 and 1.948 million to 226,250 and 1.954 million.

Bears To Sweat During Jackson Hole

Despite recent selling pressure and worries about the health of equity markets, the S&P 500 is less than 2% away from its all-time record. It is a weak seasonal period nonetheless, and what could produce turbulence to the downside is a hawkish message from Fed Chair Powell during his last Jackson Hole speech tomorrow morning. But market bears are poised to sweat it out, as they hope for a Déjà vu moment of 2022, when the central bank leader threw cold water on optimism regarding monetary policy accommodation. The enthusiasm in stocks, however, and fresh data pointing to reaccelerating conditions place the bar high for significant volatility, especially as corporate earnings expectations continue climbing. Finally, if job growth averaging 123k in the months of May, June and July motivated a 50-bp cut last September, why wouldn’t an average of 35k justify at least a 25-bp reduction this year?

International Roundup

Eurozone Flash PMI Hits 15-Month High

The eurozone Flash Composite PMI rose from 50.9 in July to 51.1 this month, its highest level in 15 months and above the economist consensus estimate of 50.7. While the services component fell from 51 to 50.7, the manufacturing sector climbed to 50.5, a 41-month high, after July’s result of 49.8, which was below the contraction-expansion threshold of 50. Economists expected results of 49.5 and 50.8 for the manufacturing and services indexes.

Businesses in both the services and manufacturing sectors reported an acceleration in input costs and output costs. Services companies continued to add staff, marking the sixth-consecutive month of payroll expansion while the manufacturing workforce decreased. Additionally, overall business confidence weakened for the second-consecutive print and hit a four-month low.

Japan Manufacturing Continues to Contract

Japan’s services sector remains in expansion and contraction of the country’s manufacturing industry has slowed considerably, according to the Flash PMI. The manufacturing version of the index climbed from 48.9 in July to 49.9 this month, surpassing the economist consensus estimate of 49.2 and staying narrowly below the contraction-expansion threshold of 50. The services index, meanwhile, dropped from 53.6 to 52.7.

South Korea Monthly Wholesale Price Pressure Climbs

The South Korea Producer Price Index climbed 0.4% m/m in July, an acceleration from 0.1% in the preceding month but in-line with expectations. On a y/y basis, the gauge matched June’s 0.5% gain.

The agricultural, forestry and marine products category led the m/m increase, jumping 5.6%, followed by services at 0.4% and manufactured products, which climbed 0.2%. Utilities fell 1.1%.

Annualized Inflation in Hong Kong Exceeds Estimates

The Hong Kong CPI climbed 0.6% m/m in July, accelerating from June’s goose egg print, and the y/y result fell from 1.4% to 1%, according to the Census and Statistics Department. The annualized result was hotter than the 0.8% estimate from a consensus of economists. Housing prices were up 1.8% y/y while alcoholic beverages and tobacco climbed 1.7%. Prices for take-out meals were also up, increasing 1.3%. Conversely, clothing and footwear stickers fell 3.3% and durable goods were down 2.3%.

Wholesale Prices for Fuel and Raw Materials Climb in Canada

Canadian wholesalers increased their prices for diesel fuel and raw materials, which pushed the country’s Industrial Product Price Index up 0.7% m/m in July, according to Statistics Canada. The gauge exceeded the economist consensus estimate of 0.3% and June’s 0.5% print. Relative to July of last year, the metric was up 2.6%, considerably hotter than the 1.9% y/y increase in June.

As Small Business Sentiment Turns Negative

Sentiment among small businesses turned negative this month with the CFIB Business Barometer dropping from 51.5 to 47.8. The gauge is based on businesses’ 12-month forward expectations. A reading of 50 is the threshold between negative and positive. Prior to August, the barometer had climbed in each of the past four months. Respondents cited insufficient demand as the primary hurdle to expanding their businesses. A separate gauge measuring optimism for the next three months also weakened, falling 2.6 points to 46.8.

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account