Originally Posted 20 August 2025 – Monthly Cash Review – EUR

Policy

The European Central Bank (ECB) Governing Council (GC) maintained the deposit rate at 2.00% at its meeting on 24 July, a decision that was in line with market expectations.

Data

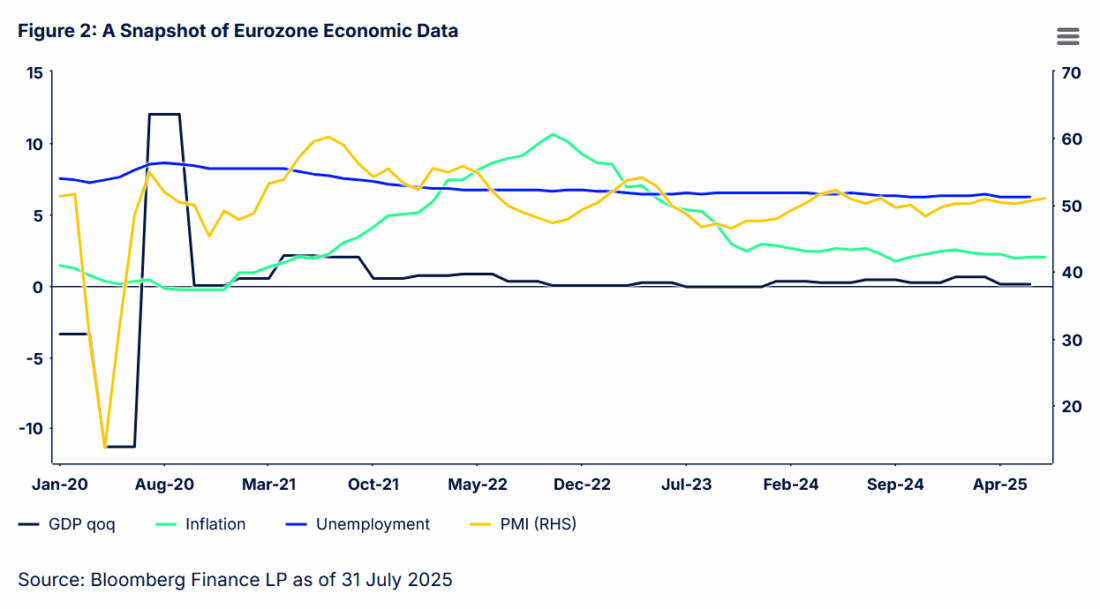

• Headline inflation for July was unchanged at 2.0%, marginally above consensus expectations of 1.9%. Energy inflation was little changed, while food inflation edged up. Core inflation was also stable at 2.3%. Services inflation declined from 3.3% to 3.1%.

• Eurozone GDP growth for Q2 2025 was reported at 0.1%, which was slightly better than the consensus forecast of zero growth.

• The eurozone composite purchasing managers’ index (PMI) for July edged up to 51.0 from 50.6 in June, exceeding consensus expectations of 50.7. The improvement was driven by a 0.7 increase in the services PMI to 51.2. Readings above 50 are indicative of growing activity.

• The eurozone unemployment rate for June remained at 6.2%.

Outlook

Following the ECB’s decision to leave its deposit rate unchanged, the bank presented no guidance on future rate decisions. The ECB published a short statement which said domestic price pressures “have continued to ease, with wages growing more slowly” and the economy was proving resilient in a challenging environment but caveated this by acknowledging that the outlook “remains exceptionally uncertain”. At the post-meeting press conference, ECB President Christine Lagarde noted that activity was “developing a little better than expected” and the resilience of the economy early this year was not solely due to tariff front-running but also reflected strengthening consumption and investment. Lagarde noted that the ECB forecast was for inflation to be below 2% next year. The ECB will remain data-driven in its decision-making process.

Economic data release in the month showed the eurozone economy holding up relatively well in the face of tariff uncertainty. Both headline and core rates were unchanged and broadly in line with the ECB’s forecasts. GDP data suggests that activity has been more resilient than expected. Front-running of the expected US tariffs gave the economy a boost in Q1 2025, and the impact of tariff uncertainty has been less than initially anticipated. The July Economic Sentiment Indicator from the European Commission was higher than expected, rising from 94.2 in June to a five-month high of 95.8 — although this was taken prior to the EU-US trade deal announcement. However, July’s composite PMI points to weak GDP growth at the start of Q3 2025. One aspect which will provide comfort to the ECB is that services price pressures are continuing to ease.

On 27 July, EC President Ursula von der Leyen and US President Donald Trump announced a trade agreement. Under the deal, the US will apply a 15% tariff on a majority of EU goods coming into the country, including cars and car parts, while tariffs on certain strategic products (aircraft, certain chemicals, drugs and generics, and natural resources) should be set back to pre-January 2025 levels. Many aspects are unknown as the introduction of the agreement has been delayed until 8 August. The agreement is currently not legally binding, and details require further negotiation. There are signs of differing interpretations around some aspects of the proposed deal. The agreement has been criticised by some European governments as being too punitive and having differing impacts on countries. The initial projection is that this outcome may reduce eurozone GDP by 0.2%.

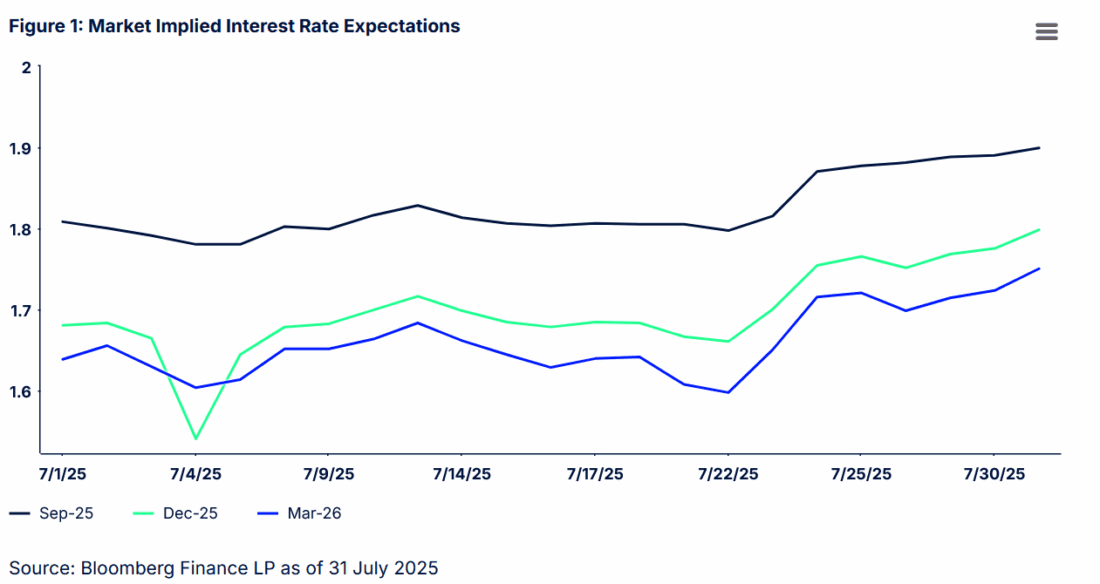

The market implied rate for September finished July at 1.90%, with expectations for a rate cut dissipating after the ECB meeting. It seems likely that policymakers will adopt a wait-and-see approach going forward, but there is arguably little in the economic data to suggest that the ECB will resume its easing cycle. The trade tariff deal, while marginally higher, was close to the 10% tariff assumed in the ECB’s baseline scenario in June, meaning that major downside risks have been avoided. The implied rates for December 2025 and March 2026 were 1.80% and 1.75%, respectively, indicating that the market is expecting one interest rate cut by March 2026.

Past performance is not indicative of future results

Forecast are based upon estimates and reflect subjective judgments and assumptions. There can be no assurance that developments will transpire as forecasted and that the estimates are accurate. The above targets are estimates based on certain assumptions and analysis made by SSGA. There is no guarantee that the estimates will be achieved.

Fund

The ECB decision to keep the policy rate unchanged prompted the market to shift to a view that the ECB may potentially be nearing the end of its rate-cutting cycle. Prior to the meeting, the fund invested in mostly shorter-term securities for the higher yields offered versus duration investments, but following the ECB meeting market yields moved higher and the fund added duration in higher credit quality investments. Fund AUM throughout the period remained in the region of EUR 9 billion with the weighted average maturity (WAM) increasing over the period to end the month at 49 days. Fund liquidity was covered with a combination of government and supranational holdings, gilt repo, and bank deposits. Fund liquidity requirements, both overnight and weekly, remained well in excess of minimum requirements at all times. The fund credit rating also exceeded requirements at all times.

Past performance is not indicative of future results

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account