Key takeaways

Fed independence matters

If markets perceive the Federal Reserve (Fed) as an extension of the executive branch, the consequences could be severe.

Tariff-impacted prices

Prices are starting to rise in tariff-impacted categories like major appliances, sporting goods, toys, and household linens.

Resilient markets

Markets continued to remain steady, but some industries could win or lose under the new One Big Beautiful Bill.

Austin Powers: Only two things scare me, and one is nuclear war.

Basil Exposition: What’s the other?

Austin Powers: Excuse me?

Basil Exposition: What’s the other thing that scares you?

Austin Powers: Carnies.

This month, I learned what truly scares me, and it’s not carnies. I enjoy carnivals. What unsettles me is the growing politicization of the US Federal Reserve (Fed).

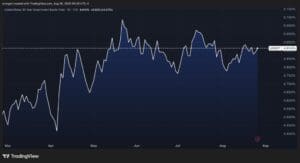

Saying that the Fed’s independence is essential shouldn’t be controversial. One of its core responsibilities is to maintain price stability and anchor inflation expectations. If markets begin to perceive the Fed as an extension of the executive branch rather than an independent institution focused on its dual mandate, the consequences could be severe.

We don’t have to look far for a cautionary tale. In the 1970s, President Nixon’s pressure on Fed Chair Arthur Burns contributed to a period of elevated inflation and persistently high interest rates, conditions that weighed heavily on US risk assets for years.1 I was born in that decade, but I have no desire to relive it. Besides, I’ve long since lost my polyester leisure suits!

Fortunately, President Trump denied reports that he plans to fire Fed Chair Jerome Powell. Here’s hoping that denial holds.

“Smashing, groovy, yay capitalism!”

It may be confirmation bias but…

… prices are starting to rise in categories affected by tariffs, such as major appliances, sporting goods, toys, and household linens, to name a few.2 We’re likely still in the early stages of these price increases.

Fortunately, the core Consumer Price Index (CPI) remains stable, as the pace of service price growth continues to slow.3 The rising prices of tariff-impacted goods, in our view, should be seen as a one-time price shock rather than the onset of a prolonged inflationary trend.

Past performance is not indicative of future results

Since you asked

Q: Haven’t you always said that elections don’t matter as much for markets as investors believe? But aren’t there clear winners and losers in the One Big Beautiful Bill?

A: Thanks for listening! My point has always been that election outcomes don’t fundamentally alter the trajectory of the broad stock market. Just look at the S&P 500 Index returns from the past three inauguration dates through mid-July:4

- Trump (2017): +9.4%

- Biden (2021): +13.2%

- Trump (2025): +4.2%

May I rest my case?

While government fiscal policy can certainly create industry winners and losers, industry performance can also be shaped by the strength of the economy and the direction of monetary policy. Under the One Big Beautiful Bill Act (OBBBA), potential beneficiaries include defense and security contractors, semiconductor firms, fossil fuel and traditional energy companies, private education and charter schools, and construction firms.

On the flip side, industries that may face headwinds include public healthcare providers, insurance companies, renewable energy sectors, and low-income housing initiatives, to name a few.

Phone a friend

I’m receiving questions about the so-called end of American exceptionalism. Consider me skeptical. I reached out to Ben Jones, my colleague in the UK, to get a better understanding of what’s meant by the end of American exceptionalism. His response:

“I don’t really like the term US exceptionalism. It’s far too blunt to really describe what’s going on now. My thesis is that the economies, markets, and currencies of other countries will begin to catch up after a prolonged period of its outperformance. I’m not suggesting that US stocks fall in absolute value over any meaningful time horizon. Rather, I just think that other markets could outperform the US because they’re starting to beat depressed expectations. The US will continue to have unique qualities that set it apart from many other nations. I have simply increased my exposure to assets outside the US and expect to maintain those positions.”

On the road again

My personal travels took me to Portugal for a quick summer vacation. Judging by the crowds, we were not the only tourists who decided to visit Lisbon and Porto this summer. The country is booming. I’m ashamed that our industry used to refer to it as one of the PIIGS (Portugal, Italy, Ireland, Greece, and Spain) of Europe.

Can summer please slow down?

—

Originally Posted on July 24, 2025

Above the Noise: Fed chair, rising prices, and policy winners by Invesco US

Disclosure: Invesco US

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial advisor/financial consultant before making any investment decisions. Invesco does not provide tax advice. The tax information contained herein is general and is not exhaustive by nature. Federal and state tax laws are complex and constantly changing. Investors should always consult their own legal or tax professional for information concerning their individual situation. The opinions expressed are those of the authors, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

NOT FDIC INSURED

MAY LOSE VALUE

NO BANK GUARANTEE

All data provided by Invesco unless otherwise noted.

Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s Retail Products and Collective Trust Funds. Institutional Separate Accounts and Separately Managed Accounts are offered by affiliated investment advisers, which provide investment advisory services and do not sell securities. These firms, like Invesco Distributors, Inc., are indirect, wholly owned subsidiaries of Invesco Ltd.

©2024 Invesco Ltd. All rights reserved.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Invesco US and is being posted with its permission. The views expressed in this material are solely those of the author and/or Invesco US and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at the Warnings and Disclosures section of your local Interactive Brokers website.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account