By C. Theodore Hicks II, CMT, CFP, CKA

1/ Small Caps Beginning to Move

2/ International – The Bigger Move

3/ Japan – Biggest Move

4/ Japan = Argentina?

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/

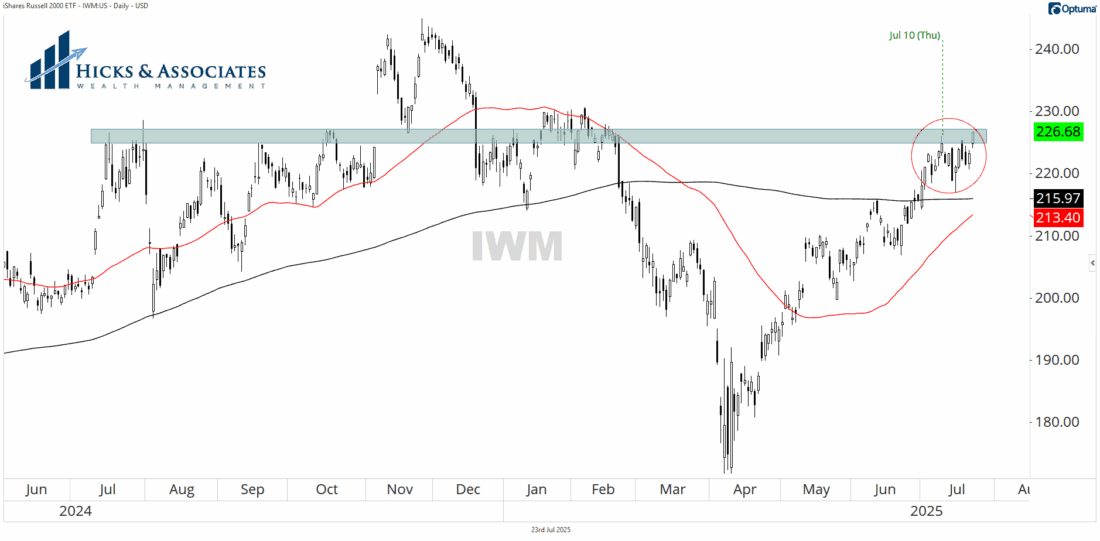

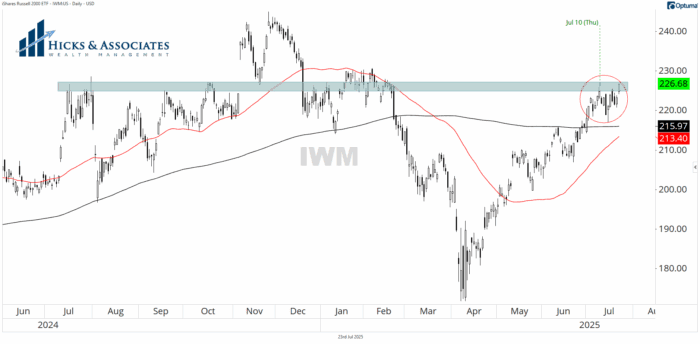

Small Caps Breaking Through

Yesterday, we looked at IWM, the iShares Russell 2000. We said that we need to see IWM break through that blue-gray rectangle. While it has not broken through just yet, Wednesday’s action was a very strong move.

While Wednesday’s price action could be defined as buyable, we generally want to see the 50-day moving average above the 200-day before we buy. However, the question I ask is simply: do you have your buy criteria clearly defined? If not, develop that first.

One more point before moving on. That blue-gray rectangle was drawn and left on my chart for a reason. When I previously examined the chart, I determined I am skeptical of this position until it passes through this area. Wednesday’s price action is admirable, and it is encouraging for the broad market’s ability to keep going. But that doesn’t mean I’m buying it.

Past performance is not indicative of future results

2/

International – The Bigger Move

While we like what we see with the small-cap ETF, do not ignore the international space. Chart 2 is VEA, the Vanguard Developed Markets ETF. Yesterday, it rocketed higher on the back of the news of President Trump’s trade deal with Japan. We’ll take a look at that in our third chart.

One of the myths that I try to dispel in my book, Evidence-Based Investing is that you must be diversified. Yes, there are benefits to diversification. But don’t be so diversified that you have diluted your winners. Ordinarily, you will hear financial advisors advocate including international in your portfolio. As for me, I only want it in a client portfolio if it is strong. Well, VEA certainly looks like strength to me.

However, as suggested above, we are not buying anything unless it hits both our trend template and our specific entry criteria. VEA has met the trend template for a while now. But we have not seen the specific entry criteria. Do you have specific criteria?

Past performance is not indicative of future results

3/

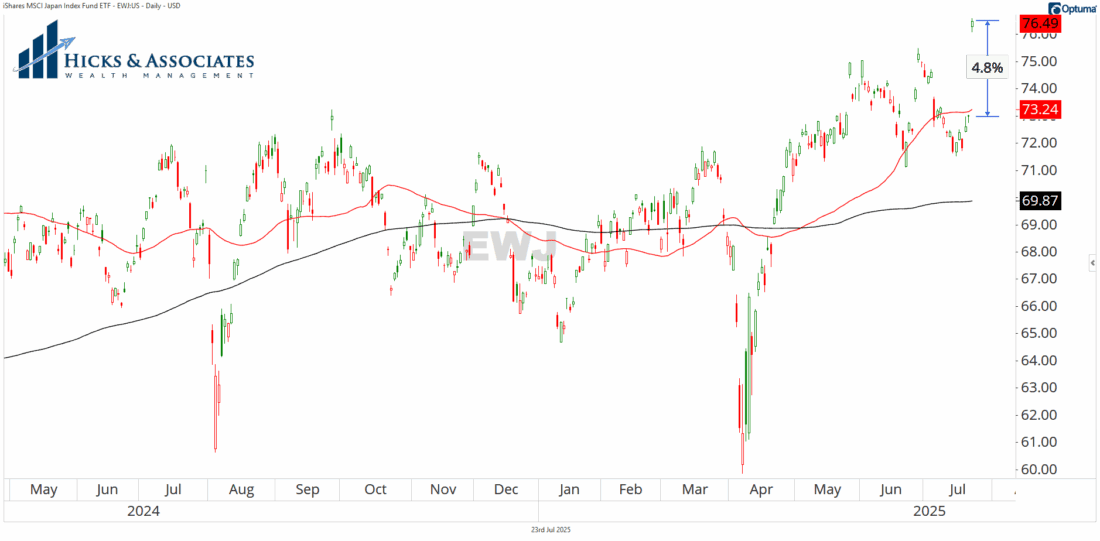

Japan – The Biggest Move

For our third chart, we will take a look at Japan via EWJ the iShares Japan ETF. If your buy criteria is to buy strength, yesterday, this was one of the strongest movers. However, from my perspective, this is a pretty ugly chart.

The big move higher might indeed be sustainable. But I see a lot of erratic behavior. I want to see a battle between the bulls and bears that contracts price. Then, our buy criteria is to buy as the bulls are victorious and move the position higher from that price contraction.

Wednesday’s move in EWJ was an impressive news driven move. Is it sustainable?

Past performance is not indicative of future results

4/

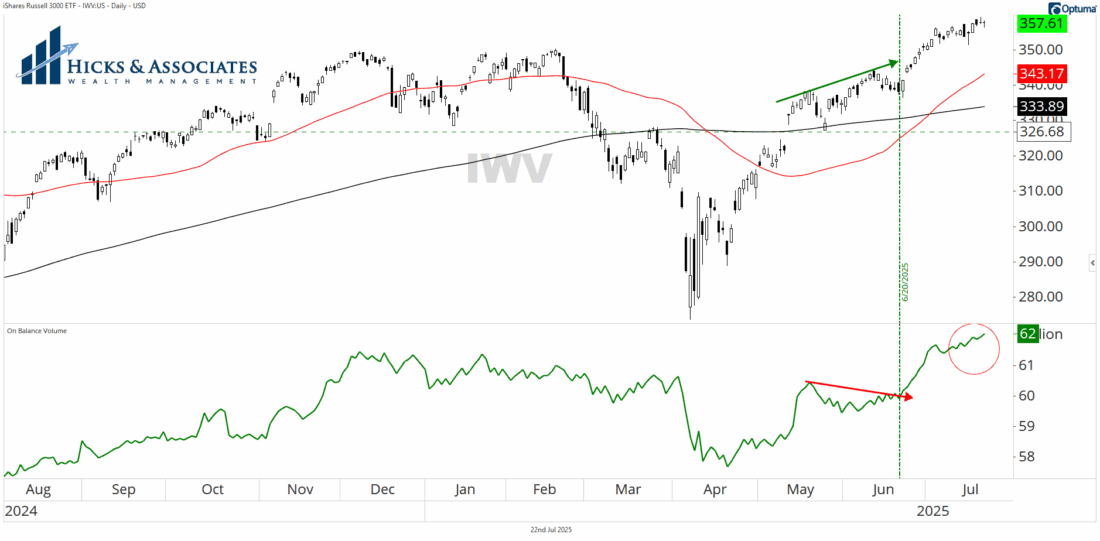

Japan = Argentina?

For our final chart for today, let’s look at another single country ETF that also had a massive news driven move.

This is ARGT the Global X Argentina ETF. The red circle just left of center, that’s highlighting election day and the day after the election when President Milei was elected. That was a massive gap higher at the open the next day. Could you have bought that? Sure. But we would not. We are not going to chase anything. Prior to that move, the ETF was breaking down.

But, once that election driven gap higher happened, it’s now on our radar. Now we begin looking to see: will it be a sustained move? Or was it a flash in the pan? We did trade ARGT a couple of times but for reasons I explain in my book, we are rarely holding something for a long term. (Ultimately, I just do not believe most of you are actually long-term investors. Perhaps I’ll elaborate on why in tomorrow’s newsletter.)

Shortly after that election, we see ARGT begin to move sideways. As it began to move out of that area, that’s what we would consider a good entry point.

If you are enjoying this week’s newsletter, be sure to connect with me on LinkedIn or follow me on Twitter.

Past performance is not indicative of future results

—

Originally posted 24th July 2025

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account