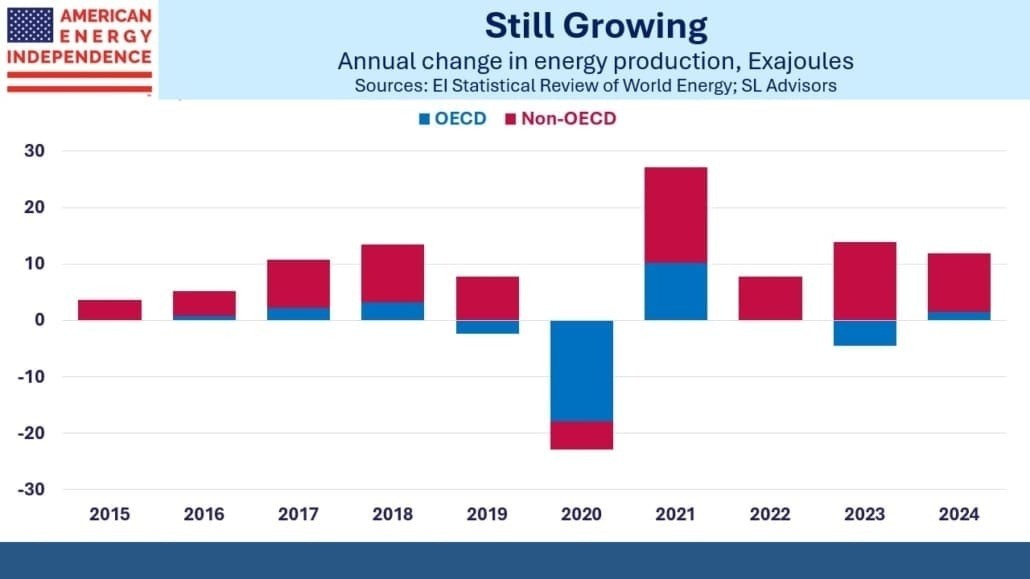

The Energy Institute’s (EI) Statistical Review of World Energy provides a wonderfully detailed view of what’s actually happening, mostly untainted by any political bias. The world is using more of all kinds of energy, raising living standards across the developing world. Hydrocarbons still dominate and will for the foreseeable future.

There’s still a tendency even at the EI to focus on percentage increases rather than absolute values when it comes to renewables. For example, while “…wind and solar grew nearly nine times faster than total energy demand” is a true statement, it compares the percentage growth rates and so isn’t that meaningful. The pressure to express optimism around intermittent energy sources extends broadly.

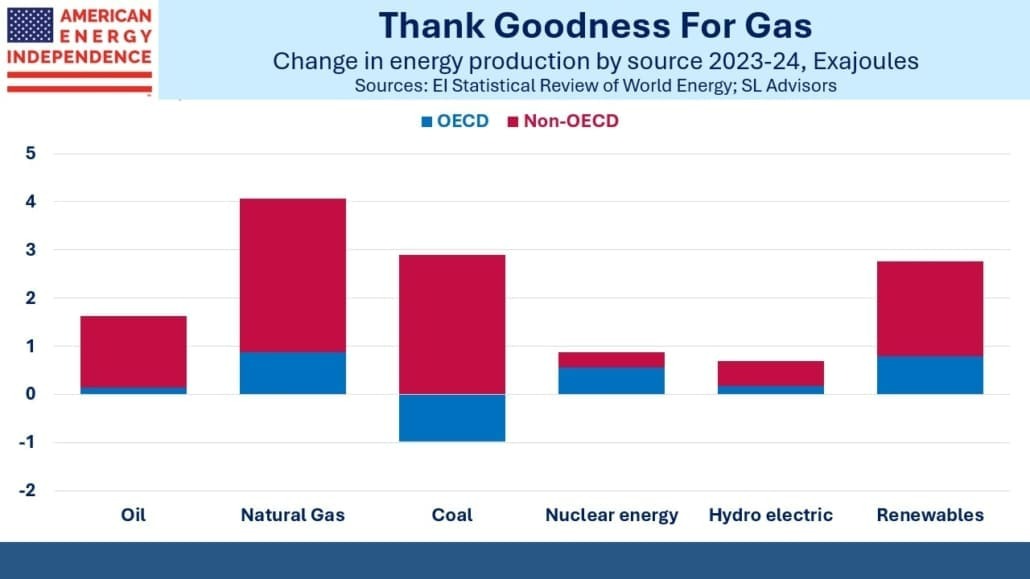

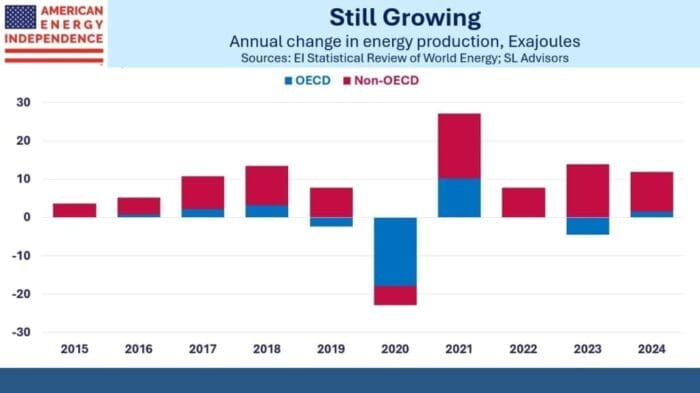

More accurate is to note that renewables production increased by 2.8 Exajoules (EJs) last year. One can cheer the 9.2% increase, or note that global energy production increased by 11.9 EJs last year and renewables were just under a quarter of this. Natural gas production grew at only 2.8%, but provided 4.1 EJs of additional energy, almost half as much again as renewables.

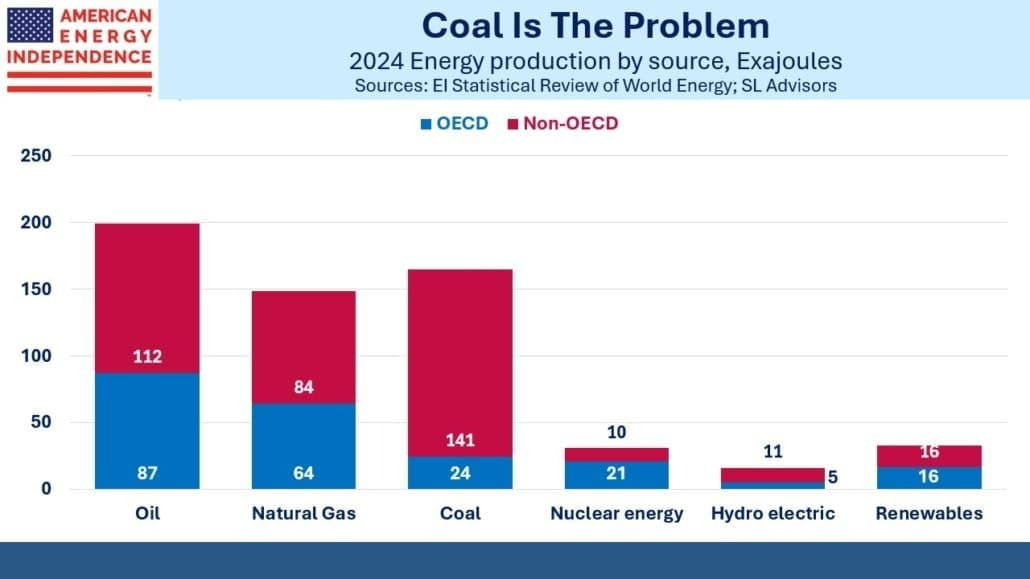

Natural gas met over a third of the world’s growth in energy demand last year and provided a quarter of the total. Overall, hydrocarbons fell from 87% to 86.6% of the total. It’s a true statement to say that renewables are gaining market share, reaching 5.5% last year from 5.2% in 2023. This also means that an investor in hydrocarbon energy infrastructure with a bias towards natural gas doesn’t need to be too concerned about solar and wind becoming dominant.

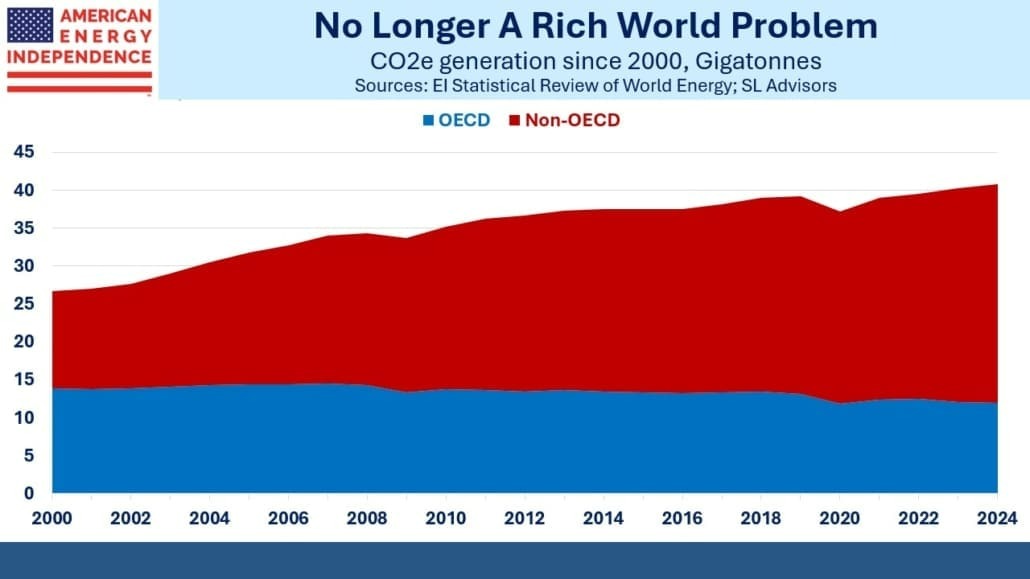

In 2006 Al Gore’s documentary An Inconvenient Truth raised public awareness about the risks from climate change. It also predicted that Arctic sea ice would disappear by 2013 and that Florida would disappear within decades. These were wrong in timing, but directionally had some merit.

Four years before Gore’s documentary, developed country emissions (defined as OECD) were bigger than emerging countries’ (non-OECD). If your goal was reducing them, the rich world needed to play a role. In 2003 non-OECD emissions became the larger of the two. In 2007, the year after the documentary, rich world emissions peaked.

Last year, Greenhouse Gas emissions (GHGs) increased by 1.3% to 40.8 Gigatonnes (GTs, billions of metric tonnes) on a CO2 equivalent basis (CO2e). OECD countries were 12.0 GTs, non-OECD 28.8 GTs. Whatever the moral argument that per capita emissions are bigger in rich countries and should shoulder more of the burden, non-OECD populations and emissions overwhelm. Liberal efforts to block natural gas hookups and build offshore wind raise costs, reduce reliability and are irrelevant until poorer countries can change their trend.

Coal is the problem, both because of local pollution as well as emissions. It’s cheap, easy to use and needs to be cut. Emerging countries increased their coal use by almost three times the reduction among rich countries. China burns 56% of the world’s output. India is 14%. Both are growing. There’s little point in having the world’s biggest EV market if they run on coal, which provides 58% of China’s electricity and 75% of India’s.

Coal displacement with natural gas in emerging Asia and elsewhere is our biggest opportunity to lower GHGs.

America’s LNG exports will keep growing, solidifying our role as the world’s biggest exporter. Some criticize the sector for methane leaks and the GHGs emitted in liquefaction. But the industry is addressing the issue, recognizing that many of their buyers want the full benefit of a fuel that generates roughly half the emissions of coal.

Last week Energy Transfer announced that Chevron has increased the LNG it will buy from their planned Lake Charles export facility. The twenty year offtake agreement now covers 3 Million Tons per Annum (MTPA), up from 2 MTPA.

Past performance is not indicative for the future.

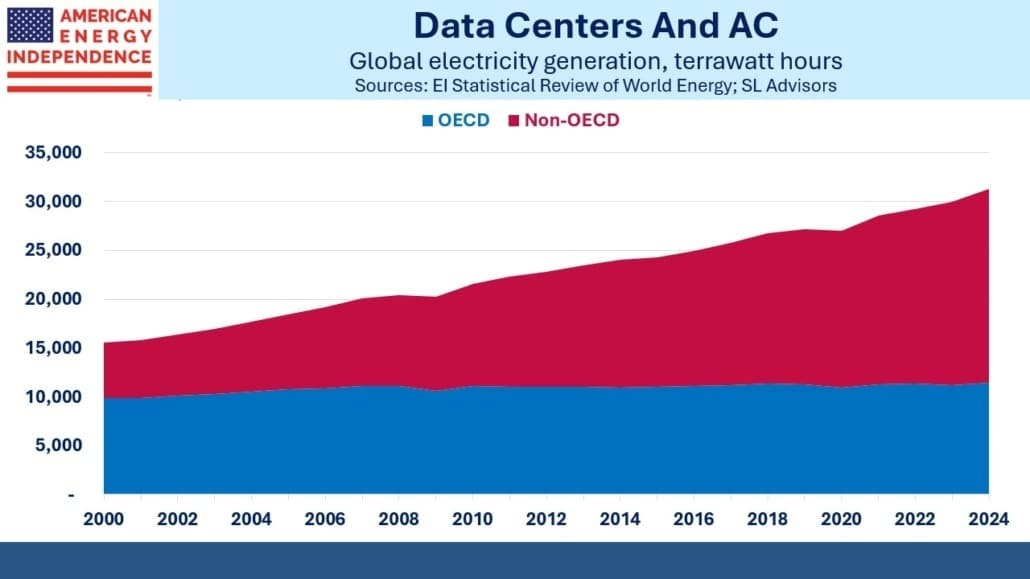

Global electricity production grew by 4% last year, well ahead of the ten year 2.6% CAGR (compound annual growth rate). Much has been written about the impact of data centers, which are causing a sharp jump in demand in the US. OECD power consumption grew at a 0.4% CAGR over the past decade, and 4.2% in emerging countries.

AC is a big driver in countries such as India, which makes increased LNG exports critical to curbing their voracious appetite for coal.

Naples, FL is one of the most politically conservative places in America. It’s very red, and its population includes quite a few who would assert climate change isn’t real. Nonetheless, one local church that has endured repeated flooding from storm surges, including last October, has concluded that such events are more likely and has decided its best defense is to raise the entire building. For some, pragmatism trumps conviction.

—

Originally Posted June 29, 2025 – Energy By The Numbers

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Disclosure: SL Advisors

Please go to following link for important legal disclosures: http://sl-advisors.com/legal-disclosure

SL Advisors is invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from SL Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or SL Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account