The month in summary:

A look back at markets in April when the announcement of “Liberation Day” tariffs by President Trump sparked significant stock market volatility while the US dollar weakened and gold hit a new all-time high.

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

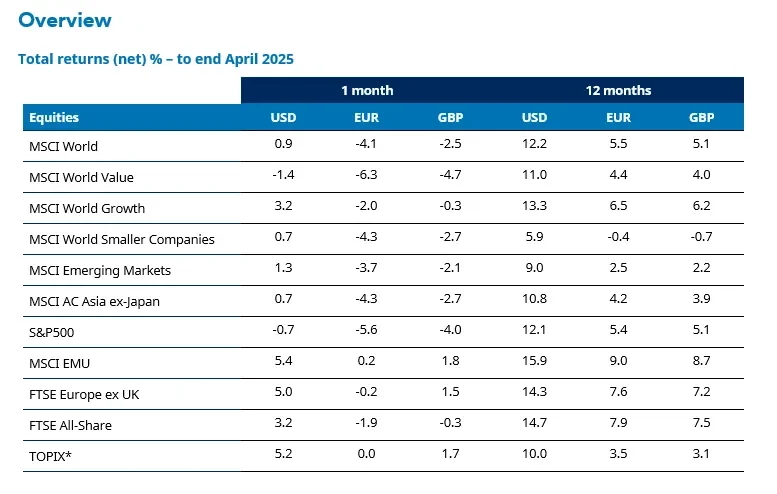

Global equities

US

US shares fell in April, underperforming most other regions. Equities experienced significant swings following “Liberation Day” on 2 April which saw President Trump announce sweeping tariffs on imported goods. The tariffs were larger and broader based than expected (a 10% tariff rate on all US imports and higher “reciprocal” tariffs for countries with which US has large trade deficit). The new tariffs were later suspended for 90 days for most countries while negotiations take place, and this helped shares recover.

- Find out more: Podcast: The week that roiled global markets

Markets were also rattled by worries over the ongoing independence of the Federal Reserve (Fed) although these fears were calmed mid-month when Trump stated he had “no intention” of firing Fed chair Jay Powell.

Data showed that the US economy contracted by an annualised 0.3% in Q1. US inflation (as measured by the consumer price index figure from the Bureau of Labor Statistics) fell to 2.4% in March from 2.8% in February.

Energy was the weakest sector amid lower crude oil prices. Other sectors registering declines included healthcare, financials and materials. The top performing sectors were consumer staples and information technology.

Eurozone

Eurozone shares were slightly positive in April. As in the US, energy was the weakest sector. Defensive areas of the market, including consumer staples and utilities, outperformed.

The eurozone economy grew by 0.4% quarter-on-quarter in Q1, according to an estimate from Eurostat. The European Central Bank cut interest rates by 25 basis points (bps) and said the outlook for growth had deteriorated given the US tariff announcement.

- Find out more: Trump tariffs: how might the EU respond?

In Germany, incoming chancellor Friedrich Merz struck a deal to form a coalition government with the Social Democrats (SPD). The German Ifo business climate index rose slightly in April to 86.9, up from 86.7 in March.

UK

UK shares were slightly weaker in April with the energy sector again the main laggard while the defensive utilities sector was the top performer. The more domestically focused FTSE 250 index outperformed the more internationally focused large cap FTSE 100 index.

Inflation fell to 2.6% in March, down from 2.8% in February, according to the consumer price index released by the Office for National Statistics. Data showed that UK annual public borrowing was £14.6 billion more than expected in the year to March.

Japan

In Japan, the Topix index registered a small positive return in yen terms. The Nikkei 225 performed better, gaining 1.2%. Japan secured priority tariff negotiations with the US in the wake of “Liberation Day”, although no deal had been concluded by month end.

Many Japanese companies began announcing their full-year earnings and providing guidance for the next fiscal year. One positive development stood out: the volume and scale of share buyback announcements to date have significantly exceeded those of the previous year, which was itself a historic high.

Emerging markets

The MSCI Emerging Markets (EM) index registered a small positive return for the month, outperforming developed markets, helped by a weaker US dollar. Mexico was the top performing market in the MSCI EM index as it faced no new trade tariffs on “Liberation Day” on 2 April. Brazil was notably strong, aided by local currency strength. India also continued to perform well, supported by easier monetary conditions following the Reserve Bank of India’s 25bps interest rate cut, improving inflation outlook and a weaker US dollar. South Africa gained, helped by record-high gold prices.

China underperformed the MSCI EM index, posting the second biggest losses among its EM peers. China responded to the trade tariffs announced by President Trump with its own levies, and the retaliatory response escalated over the course of the month. Turkey fell the most in US dollar terms given a weaker currency, ongoing inflationary pressure and an unexpected interest rate hike mid-month.

Asia ex-Japan

The MSCI Asia ex Japan index rose in April. Top performing markets included Thailand and the Philippines while China underperformed. By sector, the top performers were consumer staples and utilities while consumer discretionary and materials were laggards.

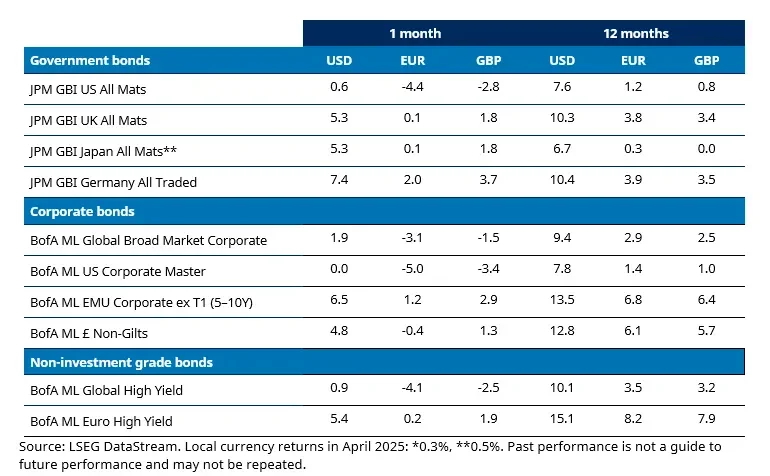

Global bonds

There was marked divergence within global government bond markets. In the US, the Treasury yield curve steepened, with yields falling in shorter maturities but rising at the longer-end of the curve (yields move inversely to price) as weak survey data reinforced the narrative of subdued economic growth coupled with higher inflation.

In Europe, yields fell across all eurozone markets and in UK gilts. The European Central Bank lowered borrowing costs by 25 bps again in April, bringing the deposit rate to 2.25%. The key message was that disinflation is “well on track”, while growth uncertainty has increased. While the Bank of England did not meet in April, market expectations for a cut in May increased. Survey data has weakened significantly, reflecting a combination of trade uncertainty and the impact of higher taxes.

Asian government bond yields fell in line with European markets. In China, manufacturing survey data has already started to show signs of a heavy hit from the escalation in trade tensions with the US.

Credit markets have experienced significant fluctuations since the new tariffs were announced. In the US, investment grade credit (IG) spreads – representing the yield difference between government bonds and credit – widened sharply on the announcement in what was a traditional “risk-off” move. A subsequent improvement in risk sentiment on the back of softer political headlines drove a partial retracement in spreads. Overall total returns were flat on the month, with energy the weakest sector, reflecting the sharp fall in oil prices.

In US high yield (HY), the energy sector was also a notable drag on the overall market. Although, despite significant spread widening on the month, total market returns were positive. It was a similar pattern for euro and sterling denominated credit, with spreads peaking at their year-to-date wides before contracting back to elevated levels in both IG and HY. Total returns were positive in both and outperformed their US counterparts.

The US dollar weakened against all major currencies, reacting to US policy uncertainty and concerns over its economic impact. Within G10 currencies, the Swiss franc outperformed, benefitting from its safe-haven status amid market volatility. Similarly, the defensive nature of the Japanese yen saw the currency supported by a flight-to-safety bid early in the month. Some of the JPY appreciation was later reversed on an improvement of risk sentiment and on expectations that the Bank of Japan would pause further rate hikes.

Commodities

The S&P GSCI Index fell in April, led lower by the energy component. Crude oil prices fell amid worries over the impact of trade tariffs on global economic growth, while additional oil supply from Opec also served to depress prices. The industrial metals component also fell in April amid growth concerns.

Precious metals registered a positive return, driven by gold. Worries over tariffs and their potential impact on economic growth saw investors turn to assets perceived as safe havens, such as gold which hit a new all-time high during the month.

- Find out more: Gold: an alternative to “safe” US assets?

The agriculture component also gained with cocoa and coffee posting the strongest advances.

Digital assets

April was dominated by the tariff news. Investors began to question the dominance of the US dollar and gold rallied significantly to all-time highs this year. Digital assets were relatively stable amid the uncertainty. Bitcoin returned 15% in the month as President Trump increasingly put pressure on the Fed.

The UK government unveiled significant draft legislation to regulate the cryptocurrency sector. This marks a pivotal step toward integrating digital assets into the country’s financial regulatory framework with a focus on seeking closer regulatory alignment with the US. The final version is expected to be introduced later this year.

Past performance is not indicative of future results

—

Originally Posted on May 6, 2025 – Monthly markets review – April 2025

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bonds

As with all investments, your capital is at risk.

Disclosure: Digital Assets

Digital Assets are not available in all regions, please check your local IBKR website for availability. Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account