Originally posted, 4 April 2025 – What’s Hot: The End of US Exceptionalism and Growth of European ETFs

Key Takeaways

- U.S. exceptionalism—the belief in America’s unmatched economic leadership—has driven disproportionate capital inflows, but that narrative is now under pressure.

- Erratic U.S. policy, weakening alliances, and rising global competition are challenging the dominance of U.S. markets and the dollar’s “safe haven” status.

- European defence and tech sectors are benefiting from structural rearmament and renewed confidence, reflected in ETF inflows.

- Non-U.S. equity markets, particularly Europe and China, are outperforming the U.S. in 2025, raising questions about a broader shift in investment priorities.

- ETF flows indicate growing investor preference for local European exposure, as confidence in U.S. dominance continues to erode.

For decades, the United States has enjoyed a status of economic exceptionalism, attracting a disproportionate share of global capital relative to the size of its economy. For instance, the U.S. accounts for approximately 72.92% of the MSCI World Index and 66.41% of the MSCI ACWI Index—both market-cap-weighted—despite contributing only 26.3% to global GDP.

What is U.S. exceptionalism?

U.S. exceptionalism refers to the belief that the United States possesses unique economic strengths that make it a standout—or even superior—environment for innovation, growth, and long-term investment compared to other nations. This idea has historically served both as an investment narrative and as a reflection of real structural advantages within the U.S. economy.

Key Drivers of This Perception:

- Innovation & Tech Leadership: The U.S. is home to many of the world’s most innovative and valuable companies (e.g., Apple, Microsoft, Google), with tech serving as a major engine of market performance.

- Deep, Liquid Capital Markets: U.S. financial markets are among the world’s most developed and accessible, making capital-raising and investment activity highly efficient.

- Rule of Law: A robust legal framework protects property rights and enforces contracts, fostering investor confidence.

- World Reserve Currency: The U.S. dollar’s status as the global reserve currency provides unique advantages in trade and financing.

- Favourable Demographics & Immigration: Compared to peers like Japan and much of Europe, the U.S. benefits from more favourable demographic trends and a steady inflow of skilled immigrants.

Historic Implications of

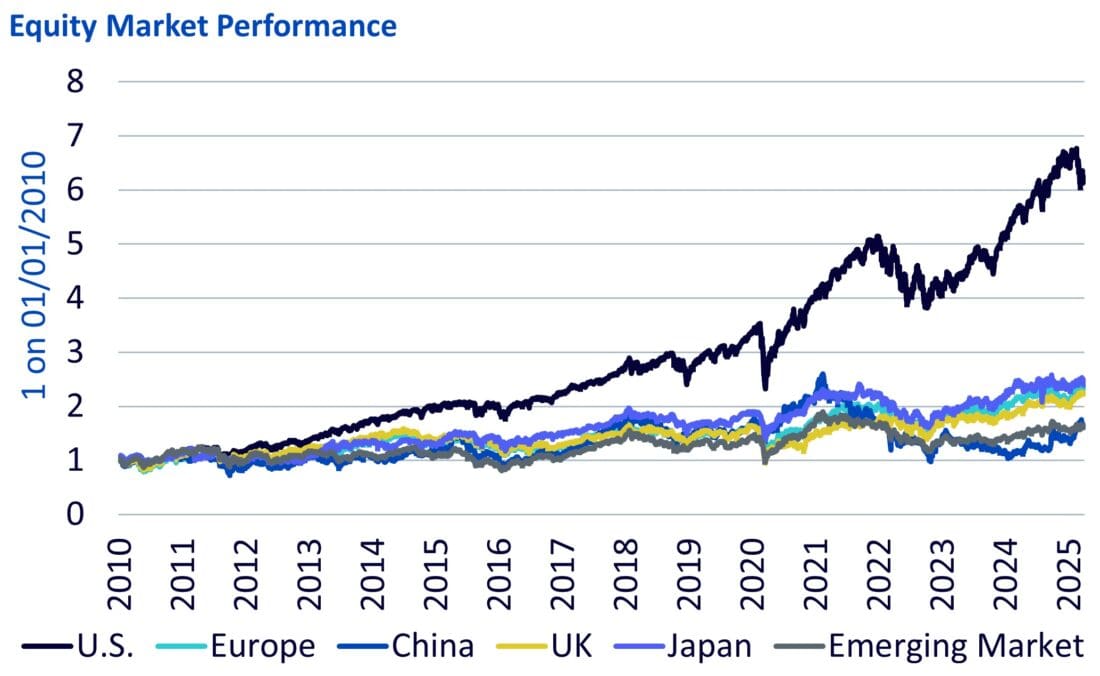

- Equity Outperformance: Over the past few decades, U.S. stocks — particularly large-cap tech and growth companies — have outperformed most global peers (see Chart 1). Investors often overweight U.S. equities in global portfolios.

- Flight to Safety: During global crises or uncertainty, investors often flock to U.S. assets (like Treasuries or the dollar), reinforcing the perception of the U.S. as a safe and reliable economic anchor.

- Higher Productivity Growth: The U.S. is seen as more dynamic and resilient, with flexible labour markets and a strong entrepreneurial culture that fuels economic recovery and innovation.

Source: Bloomberg, WisdomTree. 01/01/2010 to 03/04/2025. Based on MSCI Net Total Return USD Indices. Historical performance is not an indication of future performance and any investments may go down in value.

Mounting Doubts Around U.S. Exceptionalism

Lately, international investors are beginning to challenge this long-held belief. These doubts have been compounded by erratic policy moves from the current U.S. administration. The reduction of U.S. security commitments globally and a pivot toward protectionist or mercantilist trade policies have unsettled traditional allies and investors alike.

In particular, the U.S. drawdown of international security support has led many European nations to abandon prior budgetary constraints and accelerate defence spending in pursuit of military rearmament.

European governments are not making short-term, reactionary purchases—they are redesigning their defence strategies for the long term. Germany’s €100 billion special fund is set to be fully allocated by 2027, and France, Poland, and the UK have committed to record military budgets. Europe has historically relied on U.S. defence contractors for high-end military technology, but policy changes are prioritizing domestic suppliers.

Meanwhile, U.S. tech dominance is also under scrutiny. The emergence of China’s DeepSeek—a more cost-efficient AI model—has sparked fresh scepticism over the valuations of high-flying U.S. chipmakers like Nvidia. These valuations have been predicated on the belief that U.S. firms would maintain pricing power for longer than may now seem realistic.

Additionally, the U.S. dollar is losing some of its traditional “flight to safety” appeal. Following the announcement of new tariffs on April 2, 2025, which heightened fears of a slowdown in global growth, the U.S. Dollar Index (DXY) fell 2.5% within just 18 hours.

Non-U.S. Equity Markets Are Leading

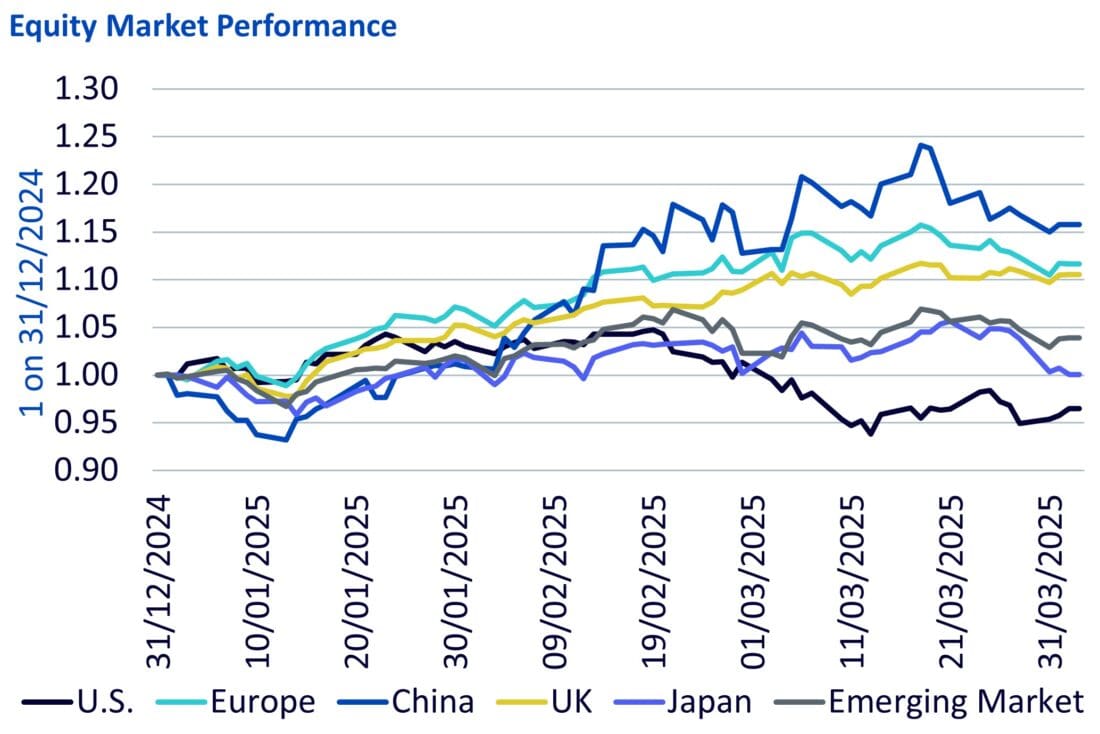

U.S. equity benchmarks have significantly underperformed their international counterparts year-to-date. As of the latest data, U.S. indices have lagged Europe by 13.6% and China by 19.3%.

While part of this divergence could be attributed to cyclical factors, there is growing concern among investors about a structural shift—one that may signal a closing of the performance gap between the U.S. and the rest of the world.

Source: Bloomberg, WisdomTree. 31/12/2024 to 03/04/2025. Based on MSCI Net Total Return USD Indices. Historical performance is not an indication of future performance and any investments may go down in value.

European investors buying more European funds

Investor behaviour reflects these changing dynamics. European ETF investors, in particular, have been reallocating capital from U.S. to European funds, as shown in the table below:

| Asset Class | 1 week flow | 1 month flow | 3 months flow | 1 year flow |

|---|---|---|---|---|

| US equities | 0.140bn | (1.6bn) | 8.3bn | 102.7bn |

| European equities | 2.1bn | 15.5bn | 29.3bn | 38.1bn |

Source: Bloomberg, as of 03 April 2025, flows in USD. Flows are shown for all ETFs listed in Europe. Figure shown in brackets is negative.

Conclusions

The decades-long narrative of U.S. economic exceptionalism is increasingly being questioned. A combination of policy unpredictability, weakening global alliances, and growing competition—especially in key sectors like technology—has eroded some of the confidence that underpinned U.S. dominance.

As non-U.S. equity markets outperform and global investment flows rebalance, European ETFs are beginning to see renewed attention. The shift may signal not just a short-term rotation, but a broader reassessment of global investment priorities.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account