Originally posted, 22 January 2025 – What does 2025 hold for 2024’s ‘winners’: silver, cyber security and US large cap equity?

Key Takeaways

- Silver is poised for further growth in 2025 as demand remains robust, supply is constrained and its correlation with gold provides a further tailwind.

- Cybersecurity in 2025 isn’t just about protecting passwords—it’s about staying ahead of smarter AI threats, navigating geopolitical risks, and preparing for the disruptive potential of quantum computing.

- A barbell strategy focussing on US large-cap quality growth and US large cap value equities could balance risk while capturing opportunities from diverging macroeconomic dynamics.

As we start a new year, we’re looking back at a selection of strong performing assets from 2024 and their outlook for 2025. Part 2 of this two-part series covers silver, cyber security and a barbell approach to investing in US large cap quality and value.

Precious potential: silver’s breakout moment

Silver rose 21% in 2024, marking one of the strongest commodity performers of the year.

Gold correlation

Silver’s strong correlation to gold played a key role, as geopolitical tensions and looser monetary policies pushed gold prices to all-time highs.

Industrial demand

Despite manufacturing activity in Europe and China being subdued in 2024, silver demand in industrial applications scaled higher to record levels in 20241. China’s aggressive push for renewable energy, including record photovoltaic (PV) installations2, significantly contributed to this demand. Innovations in photovoltaic technologies, such as the adoption of higher-efficiency N-type solar cells with increased silver content, further bolstered silver usage. Silver’s demand in industrial applications goes beyond PVs, with electronics, 5G, and automotive sectors all contributing strongly.

Supply constraints

Supply constraints added to silver’s bullish momentum. As a byproduct of mining other metals, silver supply was impacted by muted growth in mining activity growth in associated metals. In 2024, mined silver production grew by only 1%3.

This dynamic, coupled with rising demand, sustained a multi-year supply deficit for silver, which has persisted since 2021.

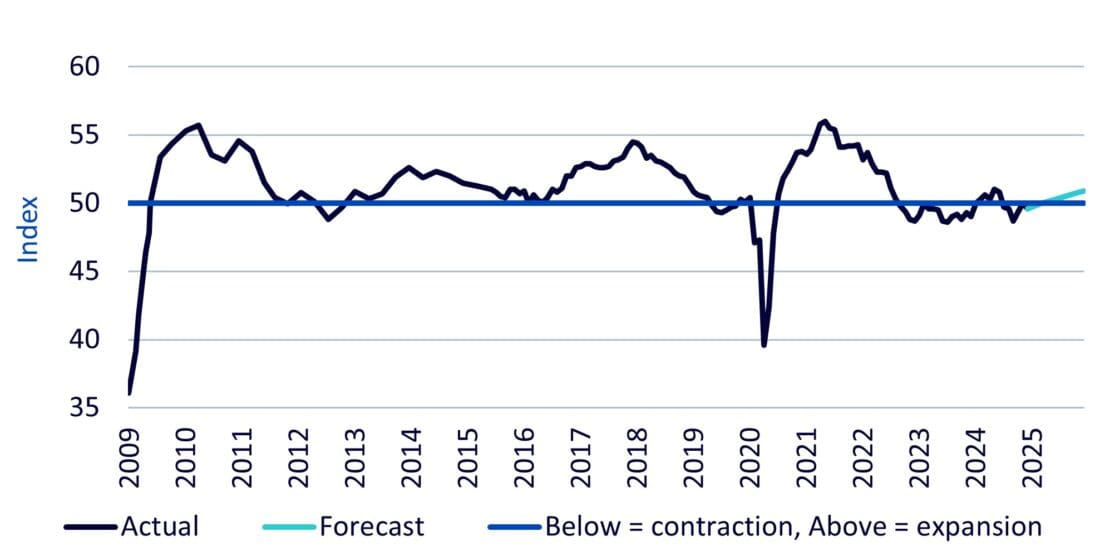

On the industrial front, demand for silver in photovoltaics and automotive applications is forecast to rise further. China’s fiscal stimulus and its leadership in green energy transitions will play pivotal roles and continue to the positive momentum for silver demand from 2024. We may also see the start of a broader industrial recovery as looser monetary policy in Europe and China aids demand. We have already started to see the Global Manufacturing Purchasing Managers Index approach 50 (indicating expansion).

Global Manufacturing Purchasing Managers Index

Source: WisdomTree, Bloomberg, S&P Global, Historic: May 2009 to December 2024. Forecasts: January 2025 to December 2025. Forecasts are not an indicator of future performance, and any investments are subject to risks and uncertainties.

Supply-side constraints are likely to persist, as silver mining depends heavily on the production of other metals, where capital expenditures remain subdued.

Together, strong demand growth and constrained supply point to a sustained supply deficit, reinforcing a bullish case for silver in the near term.

A call that cost $25 million: why cybersecurity is more important than ever

The finance worker was initially sceptical, suspecting it might be a phishing email. But their doubts disappeared when the person joined a multi-person video call with other members of the staff, including the company’s chief financial officer. Transferring $25 million to the designated account seemed like the right thing to do when instructed by leadership. Imagine the shock when it was later revealed that every attendee in that video call was a deepfake4.

This startling but true story from last year is a perfect example of how advancements in cutting-edge artificial intelligence (AI) tools are creating new risks that demand more effective cybersecurity guardrails.

When Google bid $23 billion to acquire the cloud security startup Wiz last year, it made headlines. Big tech’s willingness to pay top dollar to acquire specialist cybersecurity capabilities says a lot. But Wiz’s rejection of the bid tells us even more about the actual value of cybersecurity today5.

As we look ahead to 2025, three key forces underscore why cybersecurity is more critical than ever:

1. AI models are becoming smarter

If a deepfake was convincing enough to orchestrate a $25 million scam last year, imagine how indistinguishable they’ve become a year later. The human aspect of cybersecurity—once about not leaving your password on a Post-it note at your workstation—has evolved. It’s now about developing instincts to question and challenge everything we see in the digital world.

2. Geopolitical risks are escalating

2024 was an election year globally. While the impact of misinformation on individual minds is hard to quantify, the annulment of Romania’s presidential election in December highlights how state-sponsored actors can disrupt democratic processes6. These geopolitical threats are growing in sophistication and frequency.

3. Quantum computing is changing the game

Google’s recent breakthrough in quantum computing has opened a new chapter in the capabilities of machines and the implications for data security. Google’s Willow quantum computer performed a computation in under five minutes that would take today’s fastest supercomputer 10 septillion (10²⁵) years7. This leap underscores the urgent need to rethink how we secure sensitive information in an era of unparalleled computational power.

The case for a barbell strategy in 2025

The Magnificent 78 dominated in 2024, posting strong returns of 60%9. These leading technology companies, entrenched in growth markets, benefitted from the optimism around AI alongside strong earnings and hopes that Trump 2.0 would lower the regulatory burden on them. This aided growth-oriented stocks to return 35% in 2024, while value-oriented stocks returned only 10% over the same period10.

Record US ETF flows across styles, except for Value

This growth dominance was mirrored in ETF flows, with US growth ETF’s $39bn differential to Value ETFs marking a record setting calendar year differential11. However, this has led to stretched valuations amongst high-growth stocks trading at 32x Price to Earnings (P/E) ratio in contrast to large-cap US value stocks trading at more reasonably valuations of 19x P/E.

Source: Bloomberg, WisdomTree as of 9 January 2025. Historical performance is not an indication of future performance and any investment may go down in value.

Tailwinds for Growth and Value in 2025

The economic outlook for 2025 is characterised by uncertainty, with potential policy changes under the incoming Trump administration raising both opportunities and risks. Navigating monetary policy is rife with uncertainty. The Federal Reserve (Fed) could shift policy based on more inflationary pressure. Value stocks (often in rate sensitive sectors) may benefit from rising yields and cyclical economic momentum. Yet investors’ dilemma is that quality growth stocks, though more expensive, offer consistent earnings growth and defensiveness during market turbulence. High-quality growth stocks will be supported by strong corporate fundamentals and earnings growth. At the same time, value-oriented sectors such as Energy and Financials stand to benefit under Trump’s policies. Under the new Trump regime, energy stocks (particularly fossil fuel producers) are likely to face less regulatory pressure. Financials stocks stand to benefit from lighter regulation, higher rates and increased capital markets activity.

Source

1 Silver Institute, Silver News, December 2024.

2 Chinese installation of 334 GW in 2024, EMBER.

3 Silver Institute, Silver News, December 2024.

4 https://edition.cnn.com/2024/02/04/asia/deepfake-cfo-scam-hong-kong-intl-hnk/index.html

5 https://www.cnbc.com/2024/10/18/after-rejecting-google-takeover-wiz-says-will-ipo-when-stars-align.html

6 https://www.bbc.com/news/articles/cx2yl2zxrq1o

7 https://blog.google/technology/research/google-willow-quantum-chip/

8 The Magnificent Seven are a group of high-performing and influential companies in the US stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

9 Equal weighted performance comprised of Apple Inc., Amazon.com Inc., Alphabet Inc., Meta Platforms Inc., Microsoft Corp., Nvidia Corp and Tesla Inc. from 29 December 2023 to 31 December 2024.

10 Performance of S&P Value Index from 29 December 2023 to 31 December 2024.

11 Inflows US Growth ETFs US$114bn ; Inflows US Value ETF = US$75bn, Bloomberg as of 31 December 2024.

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers Third Party

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Precious Metals

Precious metals may not be available in all locations, please check your local IBKR website for availability.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs page. go to: IBKR Ireland FAQs or IBKR U.K. FAQs. If you have an account-specific question or concern, please reach out to Client Services: IBKR Ireland or IBKR U.K..

Visit IBKR U.K. Open an IBKR U.K. Account